COLLEGE SAVINGS 101

Will the Student Aid Bill of Rights help your family?

http://www.savingforcollege.com/articles/will-the-student-aid-bill-of-rights-help-your-family-742

Posted: 2015-03-20

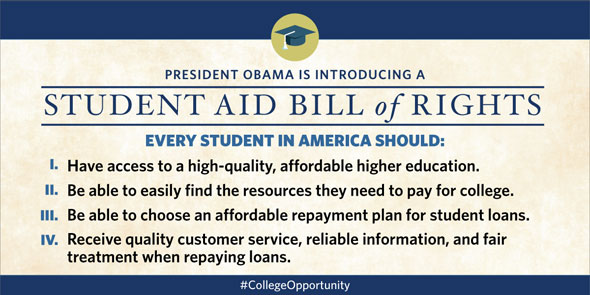

Last week, in his continued quest to improve higher education in our country, President Obama signed a presidential memorandum outlining a plan intended to help dissolve the student debt crisis. The Student Aid Bill of Rights focuses on four key issues related to helping students pay for college and helping graduates manage and repay their student loans.

The Presidentís team believes that

Students:

- Deserve quality higher education that is affordable

- Should be able to easily access resources needed to pay for college

- Have options for affordable repayment plans

- Deserve better customer service

In his statement, the President reminded us of the progress that has already been made so far toward his goals, including the free community college plan, a new college rating system, simplifying the FAFSA process, and improvements to loan repayment options. He also announced new actions in place such as a new state-of-the-art complaint system, plans to ensure prepayments are allocated to loans with the highest interest rates first (unless requested otherwise), and raising the overall standards of student loan debt collectors.

Some argue that the solution is not to make borrowing less painful, but to reduce student debt by saving more and choosing more affordable college options. An article from the Washington Post claims that the bill of rights is ďincompleteĒ and should include plans for improved loan counseling to assist new borrowers in selecting a loan they can realistically pay back.

While these are certainly great possibilities for new and current students, the unfortunate reality is that for many families itís already too late. On average, todayís students are leaving college with a bachelorís degree and a $29,000 loan balance. According to T. Rowe Priceís 2015 Family Financial Trade-offs Survey, 44 percent of respondents claimed that their own student loan obligations are impacting their ability to save for their childrenís college education. When looking only at the Millennials surveyed (ages 21-34), that number jumps to 48 percent.

So it does seem that there are borrowers out there who could use some help. If debt is preventing these families from saving, itís almost inevitable that their children will end up in a similar situation when they graduate from college. While these parents are likely aware of the dire effects loans can have, they wonít be left with many other options for their children if they arenít able to set aside any money for their education. Could the new loan assistance programs allow them to pay off their student loans faster and free up the money for 529 plan contributions?

Image source: Whitehouse.gov

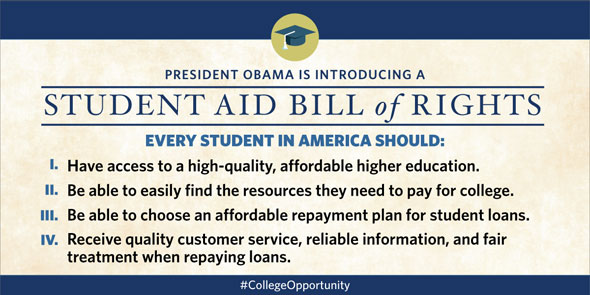

Last week, in his continued quest to improve higher education in our country, President Obama signed a presidential memorandum outlining a plan intended to help dissolve the student debt crisis. The Student Aid Bill of Rights focuses on four key issues related to helping students pay for college and helping graduates manage and repay their student loans.

The Presidentís team believes that

Students:

- Deserve quality higher education that is affordable

- Should be able to easily access resources needed to pay for college

- Have options for affordable repayment plans

- Deserve better customer service

In his statement, the President reminded us of the progress that has already been made so far toward his goals, including the free community college plan, a new college rating system, simplifying the FAFSA process, and improvements to loan repayment options. He also announced new actions in place such as a new state-of-the-art complaint system, plans to ensure prepayments are allocated to loans with the highest interest rates first (unless requested otherwise), and raising the overall standards of student loan debt collectors.

Some argue that the solution is not to make borrowing less painful, but to reduce student debt by saving more and choosing more affordable college options. An article from the Washington Post claims that the bill of rights is ďincompleteĒ and should include plans for improved loan counseling to assist new borrowers in selecting a loan they can realistically pay back.

While these are certainly great possibilities for new and current students, the unfortunate reality is that for many families itís already too late. On average, todayís students are leaving college with a bachelorís degree and a $29,000 loan balance. According to T. Rowe Priceís 2015 Family Financial Trade-offs Survey, 44 percent of respondents claimed that their own student loan obligations are impacting their ability to save for their childrenís college education. When looking only at the Millennials surveyed (ages 21-34), that number jumps to 48 percent.

So it does seem that there are borrowers out there who could use some help. If debt is preventing these families from saving, itís almost inevitable that their children will end up in a similar situation when they graduate from college. While these parents are likely aware of the dire effects loans can have, they wonít be left with many other options for their children if they arenít able to set aside any money for their education. Could the new loan assistance programs allow them to pay off their student loans faster and free up the money for 529 plan contributions?

Image source: Whitehouse.gov

If you liked this post and think it would help others save for college, please share!

Recommended Articles

SPONSOR CONTENT

Financial Professionals

Top 529 College Savings Plans

One-year rankings are based on a plan's average investment returns over the last 12 months.

| State | Plan Name | |

|---|---|---|

| 1 | New Jersey | NJBEST 529 College Savings Plan |

| 2 | Nebraska | Bloomwell 529 Education Savings Plan |

| 3 | Nevada | USAA 529 Education Savings Plan |

Three-year rankings are based on a plan's average annual investment returns over the last three years.

| State | Plan Name | |

|---|---|---|

| 1 | New Jersey | NJBEST 529 College Savings Plan |

| 2 | South Dakota | CollegeAccess 529 (Direct-sold) |

| 3 | West Virginia | SMART529 WV Direct College Savings Plan |

Five-year rankings are based on a plan's average annual investment returns over the last five years

| State | Plan Name | |

|---|---|---|

| 1 | West Virginia | SMART529 WV Direct College Savings Plan |

| 2 | Indiana | Indiana529 Direct Savings Plan |

| 3 | Alaska | T. Rowe Price College Savings Plan |

10-year rankings are based on a plan's average annual investment returns over the last ten years.

| State | Plan Name | |

|---|---|---|

| 1 | West Virginia | SMART529 WV Direct College Savings Plan |

| 2 | South Carolina | Future Scholar 529 College Savings Plan (Direct-sold) |

| 3 | Alaska | T. Rowe Price College Savings Plan |