The Higher Education Act of 1965 is the legislation that authorizes most federal student aid programs, including the Free Application for Federal Student Aid (FAFSA), the Federal Pell Grant, Federal Work-Study and federal student loans. Most legislation concerning college savings plans is controlled by the Internal Revenue Code of 1986, but the financial aid treatment of college savings plans is controlled by the Higher Education Act of 1965.

Major changes in student aid policy occur when the Higher Education Act of 1965 is periodically reauthorized.

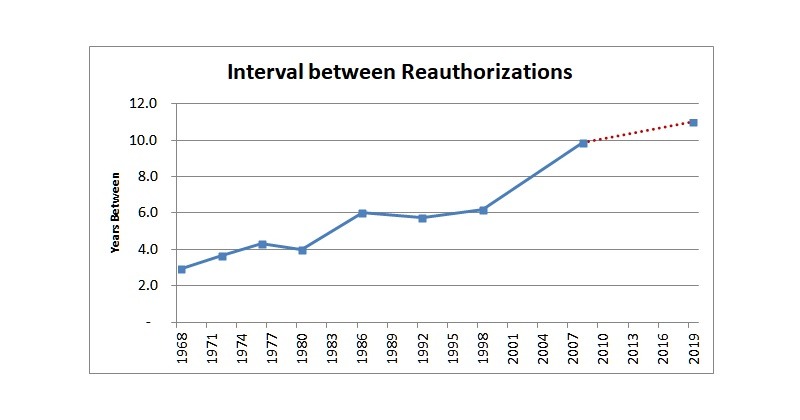

The Higher Education Act is supposed to be reauthorized every 4-5 years, but the delay between reauthorizations has been increasing with each successive reauthorization. The Higher Education Act of 1965 is overdue to be reauthorized.

Previous Reauthorizations

The Higher Education Act of 1965 (P.L. 89-329) was originally enacted on November 8, 1965. It has been reauthorized a total of eight times.

Year |

Legislation |

Public Law |

Enacted |

1968 |

Higher Education Amendments of 1968 |

P.L. 90-575 |

10/16/1968 |

1972 |

Education Amendments of 1972 |

P.L. 92-318 |

6/23/1972 |

1976 |

Education Amendments of 1976 |

P.L. 94-482 |

10/12/1976 |

1980 |

Education Amendments of 1980 |

P.L. 96-374 |

10/3/1980 |

1986 |

Higher Education Amendments of 1986 |

P.L. 99-498 |

10/17/1986 |

1992 |

Higher Education Amendments of 1992 |

P.L. 102-325 |

7/23/1992 |

1998 |

Higher Education Amendments of 1998 |

P.L. 105-244 |

10/7/1998 |

2008 |

Higher Education Opportunity Act of 2008 |

P.L. 110-315 |

8/14/2008 |

Increasing Interval between Reauthorizations

The Higher Education Act of 1965 is supposed to be reauthorized every 4-5 years. The legislation expires after four years, with an automatic one-year extension. If Congress is unable to reauthorize the legislation within this timeframe, it passes short-term extensions. For example, Congress passed a total of 13 extension bills until the Higher Education Act of 1965 was finally reauthorized in 2008.

A difficult political environment and the complexity of the legislation contributes to delays between successive reauthorizations, as shown in this chart. Ten years passed between the 1998 and 2008 Reauthorizations.

Split Control of Congress

Reauthorization is likely to occur in 2019 because the split control of Congress will force cooperation and compromise between Democrats and Republicans. All previous reauthorizations have occurred when the two parties split control of Congress.

Split control of Congress prevents the passage of extreme, partisan legislation. Legislation can be enacted only with bipartisan support. Thus, split control of Congress helps shift the focus from politics to policy. Progress in passing legislation, however, is not certain, but there is a recognition by both parties that reauthorization of the Higher Education Act of 1965 is overdue.

Proposed Reauthorization Legislation

Members of Congress have proposed three major Reauthorization bills and several minor bills totaling more than 2,400 pages.

The major legislative proposals include:

- Higher Education Affordability Act [113 – S. 2954]. This bill was introduced by Sen. Tom Harkin (D-IA), chair of the Senate Health, Education, Labor and Pensions (HELP) Committee on 11/20/2014. It is a total of 875 pages.

- Promoting Real Opportunity, Success, and Prosperity through Education Reform (PROSPER Act) [115 – H.R. 4508]. This bill was introduced by Rep. Virginia Foxx (R-NC-5), chair of the House Education and Workforce Committee, on 12/1/2017. It is a total of 602 pages.

- Aim Higher Act [115 – H.R. 6543]. This bill was introduced by Rep. Robert C. Scott (D-VA-3) on 7/26/2018. It is a total of 811 pages.

The minor legislative proposals include:

- Financial Aid Simplification and Transparency (FAST) Act [114 – S. 108]. This bill was introduced by Sen. Lamar Alexander (R-TN), chair of the Senate Health, Education, Labor and Pensions Committee on 1/7/2015. It is a total of 59 pages.

- Student Protection and Success Act [114 – S. 1939, 115 – S. 2231]. This bill was introduced by Sen. Jeanne Shaheen (D-NH) on 8/5/2015. It is a total of 18 pages.

- Empowering Students Through Enhanced Financial Counseling Act [115 – H.R. 1635]. This bill was introduced by Rep. Brett Guthrie (R-KY-2) on 3/20/2017. It is a total of 24 pages.

- College Transparency Act [115 – S. 1121]. This bill was introduced by Sen. Orrin G. Hatch (R-UT) on 5/15/2017. It is a total of 24 pages.

- Faster Access to Federal Student Aid Act of 2018 [115 – S. 3611]. This bill was introduced by Sen. Lamar Alexander (R-TN) on 11/13/2018. It is a total of 16 pages.

There are dozens of additional minor bills that are duplicative of these bills or which are unlikely to be incorporated into final Reauthorization legislation.

These bills contain many proposals for reauthorization of the Higher Education Act, and many of them have bipartisan support. A proposal is deemed to have bipartisan support if it appears in separate bills that were introduced by Democrats and Republicans or if it appears in a single bill with both Democrat and Republican co-sponsors.

There are only a half dozen extremely contentious issues for which compromise might not be possible because the parties have polar opposite positions. These proposals might need to be omitted from the Reauthorization legislation for Reauthorization to occur.

The policy proposals that appear in the various pieces of legislation can give a sense as to the likely shape of Reauthorization.

Key Bipartisan Proposals

There are numerous proposals that have bipartisan support. These issues fall into the following groups:

- Simplification

- FAFSA Simplification

- Reduce Number of Student Loan Repayment Plans

- Pell Grant Proposals

- Loans

- Eliminate origination fees on Federal Direct Stafford Loans

- New Loan Limits

- Student Loan Counseling

- Consumer Disclosures

- Mandatory standard for financial aid award letters

- Improving other consumer disclosures

- Data

- Repeal ban on unit record system, which would enable program level data in addition to institution-level data

- Expand data included in College Scorecard

- Accountability

- Risk-Sharing Payments

- Require school-certification of private student loans

- Switch to Loan Repayment Rates from Loan Default Rates

- Competency-Based Education

Controversial Issues

The most prominent partisan proposals fall into three groups:

- Regulation of for-profit colleges. This includes proposals to repeal or strengthen the gainful employment rules, the 90/10 rule and the borrower defense to repayment rules, as well as the definition of a credit hour and state authorization rules.

- Loan forgiveness. This includes proposals to repeal or improve public service loan forgiveness.

- Campus sexual misconduct. This focuses on conflicts between the rights of victims and the rights of the accused.

Proposals for FAFSA Simplification

Sen. Lamar Alexander (R-TN), chair of the Senate HELP Committee, is a strong proponent of simplification of the Free Application for Federal Student Aid (FAFSA). Financial aid experts believe that the length of the FAFSA, at more than 100 questions, is a barrier to college access by low-income students. The problem is not just with the form itself, but also with the process, which requires Pell Grant recipients to repeatedly prove that they are poor.

The legislative proposals would significantly reduce the number of questions on the FAFSA, basing the expected family contribution (EFC) on just income, household size and the number of children in college.

Among other changes, this proposal would eliminate the consideration of assets. A scaled-down version of the proposal would disregard 529 college savings plan accounts as assets and income on the FAFSA.

This proposal would also drop the questions concerning convictions for the possession and sale of controlled substances while receiving federal student aid.

Proposals for Reducing the Number of Loan Repayment Plans

There are too many student loan repayment plans. Currently, there are more than a dozen repayment plans, including:

- Standard 10-year Repayment (1)

- Graduated Repayment (2)

- Extended Repayment (2)

- Income-Driven Repayment (4)

- Income-Sensitive Repayment (1)

- Alternative Repayment (3)

One proposal would replace these repayment plans with just two repayment plans:

- Standard 10-year Repayment

- Income-Driven Repayment

There is bipartisan support for this proposal, except that there is some disagreement on the details of the income-driven repayment plan. The disagreement centers on four aspects of income-driven repayment:

- Percentage of Discretionary Income. 10% vs. 12.5% vs. 15% of discretionary income

- Repayment Term. 15 years vs. 20 years vs. 25 years vs. 30 years in repayment until the remaining balance is forgiven

- Tax Forgiveness. Tax treatment of loan forgiveness

- Mandatory IDR. Automatic placement of borrowers into income-driven repayment after 150 days of delinquency

Part of the problem is that both Democratic and Republican policymakers are enamored with income-driven repayment and want to place their own mark on the income-driven repayment plan so they can claim it as their own.

Proposals for Interest Rates and Fees

Interest rates are increasing, causing concern among constituents. There is bipartisan support for eliminating interest capitalization on federal loans and for eliminating loan origination fees on the Federal Direct Stafford loan.

The two parties diverge on other proposals, such as

- Republicans have proposed dropping subsidized Federal Direct Stafford loans, so all federal education loans would be unsubsidized

- Democrats have proposed reducing collection charges and late fees

Proposed Changes to Student Loan Limits

There is some evidence that undergraduate borrowers are reaching the loan limits. There is also concern about the potential for moral hazard in the unlimited nature of the Federal PLUS loan, especially in conjunction with Public Service Loan Forgiveness.

There is bipartisan support for increasing annual and aggregate loan limits for dependent undergraduate students by $8,000 and adding a new per-student annual and aggregate loan limits for Federal Parent PLUS loans.

There are also proposals for repealing the Federal Grad PLUS loan and increasing the aggregate limit on the graduate Federal Stafford loan.

However, the loan limits for Federal Parent PLUS loans and graduate Federal Stafford Loans may be too low, forcing families to borrow from private student loan programs.

The legislation would allow financial aid administrators to reduce or prorate loan limits on a program-by-program basis, depending on the average starting salaries, enrollment status, degree level or year in school.

The new annual loan limits are shown in this table.

Year in School |

Old Limits |

New Limits |

Dependent Student |

|

|

– Freshman |

$5,500 |

$7,500 |

– Sophomore |

$6,500 |

$8,500 |

– Junior |

$7,500 |

$9,500 |

– Senior |

$7,500 |

$9,500 |

Independent Student |

|

|

– Freshman |

$9,500 |

$11,500 |

– Sophomore |

$10,500 |

$12,500 |

– Junior |

$12,500 |

$14,500 |

– Senior |

$12,500 |

$14,500 |

Parent PLUS (per student) |

COA – Aid |

$12,500 |

Graduate Student |

$20,500 |

$28,500 |

Medical School Student |

$40,500 |

$48,500 |

Grad PLUS |

COA – Aid |

Repealed |

The new aggregate loan limits are shown in this table.

Type of Borrower |

Old Limits |

New Limits |

Dependent Student |

$31,000 |

$39,000 |

Independent Student |

$57,500 |

$60,250 |

Parent PLUS (per student) |

Unlimited |

$56,250 |

Graduate Student (U + G) |

$138,500 |

$150,000 |

Medical School Student |

$224,000 |

$235,500 |

Grad PLUS |

Unlimited |

Repealed |

The main controversy involves defining the changes in loan limits as a new loan program in order to exclude Public Service Loan Forgiveness as an option for new borrowers.

Proposals for Public Service Loan Forgiveness

There is bipartisan concern about the cost of public service loan forgiveness to the taxpayer. There has been a significant growth in costs, partly due to the addition of new income-driven repayment plans and partly due to the unlimited nature of Federal PLUS loans providing the potential for moral hazard.

There is, however, disagreement over the solutions. Some of the options include:

- Means-testing of forgiveness

- Capping the amount of forgiveness at $57,500

- Repealing forgiveness for new borrowers

- Switching the program from back-end loan forgiveness to an up-front loan forgiveness program

Generally, a lot of the discussion concerns “wealthy” graduate students, such as doctors and lawyers, getting most of the benefit. Other borrowers, such as social workers and public defenders, tend to be overlooked in the discussion.

There have also been discussions concerning ways to simplify the complexity of the program, improve the guidance and instructions to borrowers, expansion to include graduated repayment and extended repayment as qualifying repayment plans, reducing the number of qualifying payments from 120 to 60, and the tax treatment of the 20/25 year forgiveness under income driven repayment plans.

Despite the disagreement, there are opportunities for compromise.

Proposals for Student Loan Counseling

College dropouts are four times more likely to default on their federal student loans than college graduates, and account for two-thirds of the defaults. A possible contributing factor is that most college graduates do not undergo exit counseling.

Student loan counseling can be improved by providing it more frequently, while the borrower is still enrolled. The loan counseling should review repayment obligations and repayment options. The student loan counseling should be targeted to borrowers who are at greater risk of default or perhaps provided every time the student borrows money to pay for college.

Student loan counseling can also be improved by personalizing it. Increasing awareness of debt is the first step in exercising restraint. Personalizing loan counseling involves providing borrowers with their current and projected loan balances and estimates of the monthly loan payments under a standard 10-year repayment plan.

Legislative proposals also require counseling for Parent PLUS loan borrowers and tracking of the cohort default rate for Parent PLUS loans.

H.R. 1635 demonstrated strong bipartisan support for improvements in student loan counseling, passing the U.S. House of Representatives on September 5, 2018 by a vote of 406-4.

Miscellaneous Student Loan Proposals

Other legislative proposals demonstrate bipartisan support and are likely to be included in Reauthorization.

- Require student loan prepayments to be treated as an extra payment as opposed to advancing the due date of the next installment unless otherwise specified by the borrower. Student loan prepayments would also be applied to the loan with the highest interest rate. The proposals would also allow borrowers to make prepayments by specifying additional auto-debit amounts beyond the required monthly payment.

- Add a discharge for Parent PLUS loans if the student on whose behalf the parent borrowed becomes totally and permanently disabled.

- Allow borrowers to separate a joint consolidation loan.

Other legislative proposals have not yet demonstrated bipartisan support, but may be included in Reauthorization.

- Enhance and restore borrower protections.

- Allow bankruptcy discharge of federal and private student loans.

- Restore a statute of limitations on federal student loans.

- Ban the offset of Social Security Benefits to repay defaulted student loans.

- Cap collection charges at the actual cost of collecting the borrower’s loans, as opposed to the average cost.

- Block suspensions of professional licenses for student loan default.

- Reduce late fees from 6% to 4% of the past due amount.

- Establish deferments, forgiveness and other benefits for farmers, entrepreneurs, STEM teachers, medical/dental internship and residency programs, borrowers in drug treatment programs, borrowers in active cancer treatment (already enacted), terrorism survivors, first responders, adjunct faculty, arts and humanities.

- Cancel $550 in student loans for each month borrower voluntarily delays receiving Social Security retirement benefits.

- Create a legal framework for Income-Share Agreements (ISA).

- Allow refinancing of older federal student loans at the current federal student loan interest rates or 4%.

- Allow refinancing of private student loans into federal student loans.

- Require loan servicers to be certified by the U.S. Department of Education. Allow servicing contracts to be terminated because of unfair, deceptive and abusive acts. Prohibit loan servicers from cross-marketing other consumer products and services to borrowers.

Proposed Improvements in Consumer Disclosures

Enhancements of consumer disclosures seem to have bipartisan support in part because they involve low or no cost. Several consumer disclosure provisions are likely to be included in Reauthorization.

- Establish a mandatory standard for financial aid award letters

- Require all private student loans to be school-certified

- Require federal education loans to have the same Truth in Lending Act (TILA) disclosures as private student loans

- Require the net price to be the most visually prominent figure on the result page of net price calculators and clearly distinguished from the net cost

- Create a universal net price calculator

- Require borrowers to receive loan statements at least once per quarter while the borrower is enrolled in school and at least once per billing cycle in repayment. Standardize information that must be included in the loan statements

- Create new disclosures before borrowers sign a Master Promissory Note (MPN) for federal student loans

Proposal to Replace Loan Default Rates with Loan Repayment Rates

Cohort default rates are prone to manipulation. Colleges and lenders can push defaults outside the measurement window by encouraging borrowers to use deferments and forbearances.

A proposed solution is to replace the Cohort Default Rate (CDR) with a Cohort Repayment Rate (CRR).

The CRR is the percentage of borrowers at an institution who reduce the principal balance of their loans by at least one dollar before the end of the second federal fiscal year following the fiscal year in which the borrower entered repayment. The CRR excludes borrowers who are in an in-school deferment or military service deferment.

Colleges with a CRR less than 45% will be subject to a 3-year suspension of institutional eligibility for Title IV federal student aid. The cutoff threshold will increase each year to 10% below the average CRR for the previous fiscal year, with a cap at a CRR threshold of 70%. There will be separate CRR thresholds for 2-year and 4-year institutions.

The proposal will phase-in the CRR over a three-year period, becoming fully effective in FY 2022.

CRRs provide several benefits over CDRs. They are less prone to manipulation than CDRs. CRRs provide a natural and uniform treatment for all loan statuses. CRRs measure progress in repaying student loan debt.

A key flaw with the CRR, however, is that it measures the percentage of borrowers making progress in paying down their debt, as opposed to the percentage of loan dollars. The Higher Education Affordability Act proposed the use of loan repayment rates that measured the progress and speed with which borrowers repaid their federal student loans after entering repayment. While this proposal was too complicated, it got the essential idea correct, which is to measure the percentage reduction in total loan dollars (including accrued but unpaid interest and capitalized interest), as opposed to the percentage of borrowers. Such a solution is more directly tied to the financial impact of loan repayment on the federal government.

Proposals for Improvements in Data Collection

It is difficult to evaluate student and institutional performance without adequate data. To improve data collection and analysis, legislative proposals would repeal the ban on a unit record system.

Instead, the National Center for Education Statistics (NCES) would be required to establish a secure and privacy-protected system that could be used to evaluate student level and aggregate data concerning enrollment patterns, progression, completion, post-collegiate outcomes, higher education costs and financial aid.

The legislation would expand the College Scorecard into a College Dashboard that includes

- Academic program level data, not just institution level data

- The percentage of students in each of the five income ranges (quintiles)

- Transfer rates, completion rates, persistence rates

- Net price, cost of attendance and need-based aid data

- Deferment and delinquency rates by institution, not just default rates

- Private student loan debt at graduation

- Mean and median debt at graduation

- Monthly student loan payment data, assuming a standard 10-year repayment plan

To facilitate this, the National Student Loan Data System (NSLDS) would be expanded to include private student loans.

Proposals for Increased Institutional Accountability

There is a lot of disagreement among policymakers about changes in institutional accountability rules. Some of the same people who are calling for increased accountability, such as risk-sharing, are also in favor of less regulation of for-profit colleges. Nevertheless, there is a possibility that some of these proposals will be added to Reauthorization as the result of negotiation and compromise.

- Risk-Sharing Payments. This proposal would require colleges to repay the federal government for 5% of the loan balance of borrowers who have not paid down their loans in the 3-year period after entering repayment. The loan balances would be reduced by the average national unemployment rate for the three year period. In effect, the risk sharing would be about 5% x (1 – CRR) x (1 – Unemployment) x Cohort Loan Volume. For example, if a college’s cohort repayment rate is 70% and the unemployment rate is 5%, then the risk sharing would be 5% x 25% x 95% = 1.2% of the cohort loan volume.

- Democrats and Republicans disagree about regulation of for-profit colleges. Democrats favor stricter regulation of for-profit colleges, such as replacing the 90/10 rule with an 85/15 rules and counting military student aid toward the 90/10 rule. Republicans favor repeal of the 90/10, gainful employment, borrower defense to repayment and state authorization regulations. Alternately, Republicans want the 90/10 and gainful employment rules to apply to all colleges uniformly, not just to for-profit colleges. Note that the Social Security Administration (SSA) is refusing to renew a data sharing agreement with the U.S. Department of Education, effectively blocking the gainful employment rules.

- Some policymakers have proposed adding more breakpoints to the Return of Title IV (R2T4) rules, not just 60%, to thwart Pell Runners. Policymakers should consider making the R2T4 rule continuous, rather than establishing breakpoints, which create cliff effects.

Pell Grant Proposals

Most proposals concerning the Federal Pell Grant are non-controversial, but include many variations.

For example, the idea of a Pell Bonus has bipartisan support, but there are several variations on this idea. The key difference is who receives the Pell Bonus.

- Colleges. This proposal would reward colleges for improvements in college affordability, access and success for low- and moderate-income students.

- States. The American Dream Grants would encourage states to increase access for low-income students.

- Students. Pell Grant recipients would be provided with an additional $300 per academic year for taking an increased academic workload each term (15 credits vs. 12 credits).

There are also proposals that do not increase costs, such as

- Publishing a table that shows the amount of Pell Grant awards based on family income and size.

- Pell as a paycheck.

A few proposals will increase the cost of the Pell Grant program:

- Year-round Pell Grant. This proposal was enacted effective starting with the 2017-2018 academic year.

- Switch the Pell Grant to 100% mandatory funding, making it a true entitlement, and index the maximum grant to inflation after increasing the maximum grant by $500.

There is also a proposal to repeal the Federal Supplemental Educational Opportunity Grant (FSEOG), implicitly rolling the funding into the Federal Pell Grant program.

Proposals for Competency-Based Education

Competency-based education provides credentials to students based on their knowledge and skills, as opposed to seat time. Students might still need classroom instruction to acquire the knowledge and skills, but competency-based education considers that some students might obtain the knowledge and skills through other means, such as in the workforce or through bootcamps.

The proposals will create a pathway for federal student aid eligibility for competency-based education programs. They define competency-based education in terms of direct assessment of student learning. A student would earn a certificate, degree or other recognized education credential upon demonstration of a set of competencies. The proposal translates competency-based education into the equivalent enrollment status for the purpose of awarding Title IV federal student aid.

The main concern is about the potential for fraud and abuse, as well as unintended consequences. Some policymakers have proposed rolling out competency-based education slowly, such as starting with a demonstration project to develop quality standards.

Proposals Concerning Campus Sexual Misconduct

Title IX of the Education Amendments of 1972 prohibits discrimination on the basis of sex in federally-funded education programs. In addition to gender parity rules, Title IX also bans sexual harassment and sexual misconduct.

Recent controversies center on tension between the rights of the accused and the rights of the victims. This manifests in several issues, such as

- Definition of sexual harassment. The Trump Administration has proposed regulations that define sexual harassment as involving “unwelcome conduct on the basis of sex that is so severe, pervasive and objectively offensive that it effectively denies a person equal access” to an education program or activity, consistent with the U.S. Supreme Court’s standards.

- Evidentiary standards. The Obama administration recommended the use of the preponderance of evidence standard, which is weaker than the clear and convincing evidence standard, which is weaker than the beyond a reasonable doubt standard. The Trump Administration has proposed allowing colleges to choose their own evidentiary standard.

- Due process. The Trump Administration has proposed adding due process protections for the accused, such as requiring colleges to allow cross-examination by a third party and to allow the use of mediation if agreed-to by both parties.

Miscellaneous Proposals

There are also numerous assorted proposals, the most significant of which include:

- Ideas for incentivizing student completion.

- Revising the allocation formula for Federal Work-Study funds and dropping graduate student eligibility.

- Proposals for facilitating free-tuition programs and no-loans programs.

- Requiring states to provide in-state tuition for members of the U.S. Armed Forces (including spouses and dependents), homeless children and youth, and foster-care children.

- Modifying the need analysis formula to increase the Income Protection Allowance (IPA) and excluding 529 plan funds from assets and income on the FAFSA. These proposals do not address the disappearing Asset Protection Allowance (APA) problem.

{{parent.title}}

{{parent.title}}

Login

Login