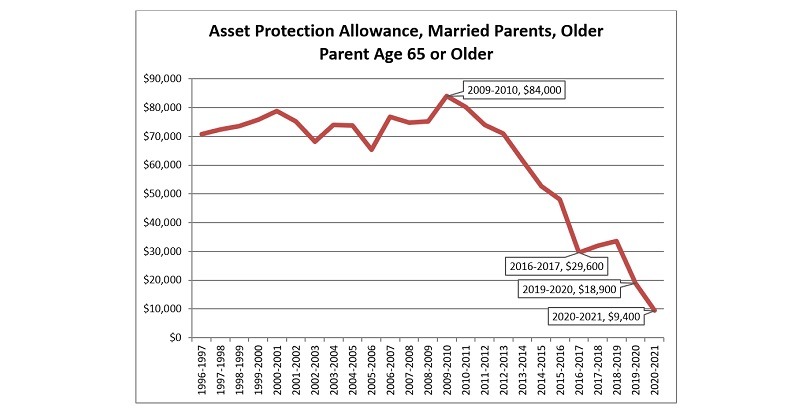

The Free Application for Federal Student Aid (FAFSA) shelters a portion of parent assets using an asset protection allowance (APA). The asset protection allowance has dropped significantly since peaking in 2009-2010 and continues to decline. If current trends continue, the asset protection allowance will disappear completely in just one more year, by the 2021-2022 FAFSA.

The asset protection allowance, which is based on the age of the older parent, is intended to cover the cost of an annuity which will supplement Social Security retirement benefits to the moderate family income level as determined by the Bureau of Labor Statistics (BLS). However, the average Social Security retirement benefit has been increasing while the moderate living standard has remained largely unchanged. As this gap narrows, it causes the asset protection allowance to decrease.

Big Decreases in Asset Protection Allowance

The asset protection allowance for a 65-year-old parent has decreased from $84,000 in 2009-2010 to $9,400 in 2020-2021. The $74,600 (88.8%) decrease is the equivalent of as much as a $4,207 cut in the student’s eligibility for need-based financial aid.

Age 48 is the median age of parents of college-age children. For these parents, the asset protection allowance has dropped from $52,400 in 2009-2010 to $6,000 in 2020-2021, a $46,400 decrease.

Asset Protection Allowance Falls Short of Sheltering College Savings

The asset protection allowance was originally called the “Education Savings and Asset Protection Allowance” [20 USC 1087rr(d)]. But, the asset protection allowance is no longer sufficient to shelter the typical college savings plan for even a family with just one child.

There aren’t any good workarounds for parents. Parents can reduce reportable assets by paying down debt and maximizing retirement plan contributions in the years leading up to college enrollment. But, this does not shelter the funds in 529 college savings plans.

Reportable Assets are Still Assessed at a Maximum 5.64% Rate

There are three factors that affect whether 529 college savings plans are counted on the Free Application for Federal Student Aid (FAFSA) and the extent to which they are counted:

- Simplified Needs Test. If the parents’ income is less than $50,000 and they satisfy certain other criteria (type of tax return filed or eligible to file, receipt of certain means-tested federal benefits or a parent is a dislocated worker), all assets are disregarded on the FAFSA.

- Asset Protection Allowance. The asset protection allowance shelters a portion of parent assets. It was originally intended to shelter college savings funds. In 2009-10, the asset protection allowance could cover as much as three years of tuition, fees, room and board at an in-state public 4-year college. Today, it covers less than a third.

- Contribution from Assets. Any remaining reportable assets, after applying the Simplified Needs Test and Asset Protection Allowance, are assessed on a bracketed scale with a top bracket of 5.64%.

Policymakers Must Fix This Problem

Only Congress can fix this problem in the federal financial aid formulas.

The simplest solution is for Congress to explicitly exclude qualified education benefits from the definition of assets on the FAFSA, and qualified distributions from the definition of untaxed income. Qualified education benefits include 529 college savings plans, prepaid tuition plans and Coverdell education savings accounts. The earnings portion of a non-qualified distribution will continue to be included in adjusted gross income (AGI).

[Editor’s note: This article was originally published on October 1, 2018 and updated on August 9, 2019.]