A 529 plan is an investment account designed to save for college or K-12 tuition. Most 529 plans offer a choice of portfolios made up of mutual funds, ETFs or similar investments. You can select a 529 plan portfolio based on your family’s individual needs, and you can make investment changes twice per calendar year.

What is a 529 plan investment change?

A 529 plan investment change happens when a 529 plan account owner moves existing funds from one investment option to another investment option within the same 529 plan.

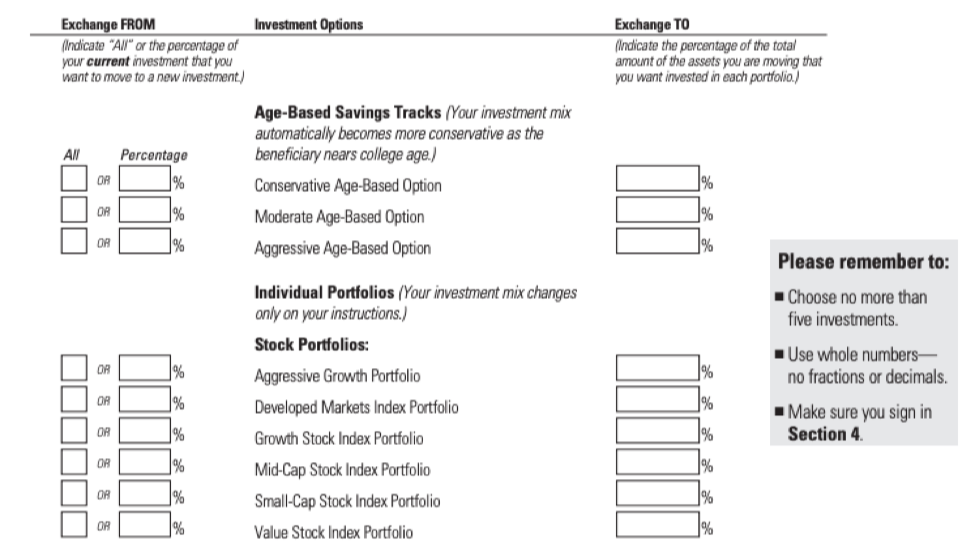

Investment change forms can usually be found on the 529 plan’s website. You will need to fill in the account owner’s name and contact information, the beneficiary’s name and date of birth and the new investment options. Your current account balance and future contributions will be invested in the new investment options selected.

Example investment change form:

Source: NY’s 529 College Savings Program

The investment change limit only applies to investment changes that are directed by the 529 plan account owner. The plan’s investment manager may make changes to the underlying mutual funds within a 529 plan portfolio, but this does not count as an investment change for the participant.

Moving funds to another 529 plan is considered a rollover and not an investment change. One tax-free rollover is permitted per beneficiary in a 12-month period. Funds can be directly rolled over into another 529 plan, or the 529 plan account owner may take a distribution from the original 529 plan and deposit the funds into a new 529 plan within 60 days.

Type of Change |

Limits |

Investment Change |

Twice per Calendar Year |

Change of Beneficiary |

Unlimited |

Rollover to Another 529 Plan |

Once per 12-month Period |

When should you change 529 plan investments?

Most 529 plans offer age-based or static investment allocations. With an age-based portfolio, the asset allocations automatically adjust based on the beneficiary’s age. Equities (stocks) are riskier investments with greater potential return. Parents with young children who have a longer investing time horizon can invest aggressively in equities since they have more time to absorb market risk. As the child gets closer to college, the portfolio aims to protect the principal by shifting toward conservative fixed income investments.

Families who do not select a 529 plan portfolio with an age-based asset allocation can manually reduce risk in their portfolio by making an investment change. The mix of 529 plan investments should be based on the child’s age. For example, when elementary school begins, it’s a smart idea to benchmark progress and increase equity exposure if you’re coming up short.

For families who invest in static portfolios, an investment change might be needed to rebalance the investment to return to the target asset allocation. You should rebalance your investments at least once a year.

An investment change might also make sense for parents who decide to use their 529 plan savings to pay for K-tuition. Most age-based portfolios are designed to help save for college. If a family plans to take a distribution before college, they’ll want to move funds out of the age-based allocation and reduce risk in their portfolio earlier.

How to get around the investment change limit

In most cases, a 529 plan will not accept a request for more than two investment changes in a calendar year. However, there is an exception when the investment change request is submitted along with a beneficiary change request. A 529 plan beneficiary can be changed at any time without tax consequences to a qualifying family member of the previous beneficiary, which includes a parent. A parent can make themselves or a sibling the 529 plan beneficiary, make the investment change, and then change the beneficiary back to the child.

This strategy also works for families who want to do more than one 529 plan rollover in a 12-month period. The 529 plan account owner would just have to designate a different family member as the beneficiary on the new 529 plan account.