Sometimes, an out-of-state 529 plan may provide a better financial value than an in-state 529 plan. When saving for college, always consider your own state’s 529 college savings plan if the state offers a state income tax deduction or tax credit based on contributions to the state’s 529 college savings plan. But, an out-of-state 529 plan may offer lower fees. Which option saves more money?

Families can invest in almost any state’s 529 plan. More than 30 states offer a state income tax break for contributions to the state 529 plan. So, it can pay to shop around.

But, how can you determine when a state income tax deduction is better than the lower fees on an out-of-state 529 plan?

Generally, lower fees matter more when the child is young and state income tax breaks matter more after the child enters high school.

The precise answer depends on the state’s marginal income tax rate, the difference in the fees and the number of years until the child enrolls in college.

A New Rule of Thumb

Consider two 529 plans. One is an in-state 529 plan which provides a state income-tax deduction. Assume a marginal state income tax rate of T. The out-of-state 529 plan has fees that are ∆F lower than the in-state 529 plan. Assume that there are N years until the child enrolls in college.

If ∆F x N > 2T, the out-of-state plan with the lower fees will yield the greater net return on investment, otherwise the in-state plan with the tax deduction is the better option.

This rule of thumb is an approximation, but it works well in practice. The tax savings is limited to just that year’s contributions, while the benefit of lower fees applies every year. So, the more years until matriculation, the greater the savings from having lower fees.

Using the Rule of Thumb

Generally, when the child is young and there are many years until the child enrolls in college, a 529 plan with lower fees will save more money. Minimizing costs is the key to maximizing net returns. As the child approaches college age, however, the greater financial benefit shifts to the in-state plan with the state income tax deduction.

There’s an inflection point where the benefit of a state income tax deduction exceeds the benefit of lower fees. The inflection point typically occurs around when the student enters high school. But, a greater difference in the fees or a lower marginal tax rate can cause the inflection point to occur later.

So, you should start investing with a 529 plan that has lower fees when the child is young, then direct new contributions to an in-state 529 plan when the child enters high school if the in-state plan offers a state income tax break.

If the in-state 529 plan offers a state income tax deduction or tax credit for contributions to the state 529 plan, you should continue to contribute to the in-state 529 plan even after your child enrolls in college, since the state income tax break can function like a discount on college costs.

But, the tradeoff between lower fees and state income tax benefits depends on the details, such as the specific difference in fees, the marginal state income tax rate and the annual contribution limit on the state income tax deduction.

The rule of thumb does not depend on the amount of the monthly contributions. However, if the state income tax break has an annual contribution limit, the value of contributions to the in-state 529 plan will stop when the contributions reach the state income tax break’s annual contribution limit. Then, further contributions that year should shift from the in-state 529 plan to an out-of-state 529 plan with lower fees.

Inflection Point between Lower Fees and Tax Benefits

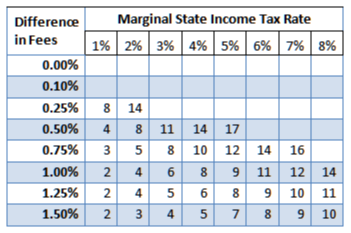

This chart shows the minimum number of years required for the specified difference in the fees to yield a better financial value than the tax deduction, assuming an annual return on investment of 6%. (Changing the return on investment does not significantly alter the inflection point.)

When the specified numbers of years remain before college enrollment, it is time to shift new contributions to an in-state 529 plan. The state income tax deduction is also more valuable when the cells are blank, regardless of the number of years remaining. For example, the state income tax deduction is always more valuable when the difference in fees is 10 bp (0.10%) or less.

Derivation of the Rule of Thumb

Let’s assume that C is the monthly contribution amount, T is the marginal state income tax rate, ∆F is the difference in fees between the in-state and out-of-state 529 plans, R is the return on investment (assumed to be the same for both 529 plans), B is the base fees (the annual expense ratio in the in-state 529 plan) and N is the number of years until matriculation.

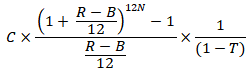

Then, the total value of the in-state 529 plan after N years is

This assumes that the savings from the state income tax deduction is invested in the 529 plan.

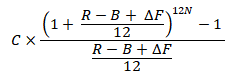

The total value of the out-of-state 529 plan is

This reflects the lower fees in the out-of-state plan and assumes no state income tax deduction. (There are seven states – Arizona, Arkansas, Kansas, Minnesota, Missouri, Montana and Pennsylvania – which allow the state income tax deduction or tax credit for contributions to any state’s 529 plan. In those states, you can choose the 529 plan with the lowest fees. Not surprisingly, these states have among the lowest fees.)

Comparing the two formulas should identify which plan yields the greater financial value.

We can simplify the comparison first by dividing both formulas by common terms, such as C and 12.

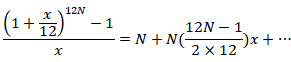

Next, we can further simplify the formulas by replacing the exponentiation by the first few terms of the Taylor expansion, dropping higher order terms and other terms that contribute less than 1 bp to the result.

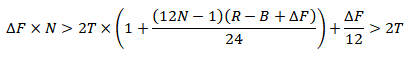

If we apply this to both formulas, divide by N and simplify, the result is a preference for the out-of-state 529 plan when

Thus, lower fees from an out-of-state 529 plan yield more financial value than a state income tax deduction for contributions to an in-state 529 plan when