Senator Lamar Alexander has proposed automatically deducting student loan payments from borrowers’ paychecks. This is an elegant idea that would save the federal government about $1 billion a year in collection costs. Payroll withholding of student loan payments isn’t as simple as it might seem initially, but the problems aren’t insurmountable.

Choice of Two Repayment Plans

Under Senator Alexander’s proposal, borrowers would have a choice of two repayment plans, an income-driven repayment plan and standard repayment.

- The income-driven repayment plan would base monthly payments on 10 percent of the borrower’s discretionary income, with discretionary income equal to the difference between adjusted gross income (AGI) and 150% of the poverty line for the family size. The remaining debt would be cancelled after 20 years of payments.

- The standard repayment plan involves level amortization over a 10-year repayment term.

Sources of Complexity

A key challenge is the amount of information that would need to be made available to the borrower’s employer.

- AGI includes both earned income, which is available to the employer, and unearned income, which is not.

- Calculating the poverty line would require information about the borrower’s family size, as well as state of residence.

- Calculating monthly payments under standard repayment would require knowledge of the borrower’s original debt or, alternately, the current amount owed and the remaining repayment term.

Sharing the borrower’s AGI with the employer represents a security risk in addition to an invasion of privacy. The IRS uses the previous year’s AGI to authenticate the identity of taxpayers who file federal income tax returns online. It would be difficult to provide this information to employers in a secure manner. Hackers could use this information to commit tax refund fraud.

Base Withholding Solely on Earned Income

Instead, the withholding should be based solely on the borrower’s earned income. This information is available to the employer, allowing the employer to calculate how much to deduct from each payment without reference to external information.

This would require the poverty line to be based on a fixed set of assumptions, such as a family size of 1 and a location of the continental U.S. Or, the actual family size could be reported by the borrower to the employer.

The calculation of discretionary income would be normalized based on paycheck frequency.

Withholding Frequency Based on Paycheck Frequency

The loan payments would be withheld from every paycheck, just as federal, state and local income taxes are currently withheld. Employers would be required to deposit the withholdings with the IRS at a predetermined frequency – semi-weekly or monthly – regardless of the frequency chosen for paychecks, the same as for tax withholding. The payments would be transferred from the U.S. Treasury to the U.S. Department of Education, who would apply them to the loan balances.

Borrowers who are self employed would need to make monthly or quarterly loan payments, just as they currently are required to make periodic estimated tax payments.

Withholding payments from every paycheck matches the granularity of payments to the granularity of income, adjusting naturally to changes in the borrower’s income. If the borrower has volatile income, the withholding would increase and decrease with changes in earned income.

Naturally Adjusts Withholding to Changes in Income

Deferments and forbearances would occur naturally, as a consequence of the design of the income-driven repayment formula. If the borrower is on unpaid medical or maternity leave, there would be no income and therefore no withholding.

Similarly, if the borrower loses his or her job, the monthly payments would naturally be suspended because unemployment compensation is typically less than 150% of the poverty line.

If a borrower does not work, the monthly payments would be zero. For example, if two borrowers are married with one working and the other a stay-at-home parent, the payroll withholding for the borrower who works would be applied to that borrower’s loans. No payments would be applied to the loans of the borrower who does not work.

Alternative to Standard Repayment

With regard to standard repayment, a simpler solution is to allow borrowers to choose any payment amount that is greater than the income-driven repayment amount. This would allow borrowers to choose to repay their student loans even faster than standard repayment, if they wish. It is consistent with the lack of prepayment penalties on federal education loans.

Borrowers who wish to use a standard repayment amount could use a loan calculator to determine the loan payment. Or, alternately, they could use the rule of thumb that monthly payments under standard 10-year repayment are about 1% of the loan balance when the loan entered repayment. Just omit the two least significant digits from the loan amount to determine the monthly loan payment. For example, $30,000 in debt corresponds to a loan payment of about $300 a month.

Allowing the borrower to choose a higher loan payment would address the scenario where a borrower works two jobs. The calculation of the monthly payment effectively subtracts 150% of the poverty line twice, once for each job, leading to under-withholding. To avoid the need for an annual reconciliation process, the borrower could increase the amount withheld to compensate. This would be the equivalent of increasing the withholding by about $72 on a bi-weekly basis or $156 on a monthly basis, given the current poverty line for a family of one.

Treatment of Unearned Income

Basing the loan payments solely on earned income would eliminate the need for a complicated annual reconciliation process, by matching the repayment obligation to the amounts withheld.

The savings from the reduced need for loan servicing and collection agencies should be sufficient to compensate for basing loan payments solely on earned income.

To address policy concerns about borrowers whose compensation is largely based on unearned income, such as capital gains, interest and dividends, there might need to be an annual reconciliation process for people who earn more than a threshold amount of unearned income. This threshold would need to be high enough so that most borrowers would not need to undergo an annual reconciliation process.

When a borrower retires, their income shifts from earned income to unearned income. Unless the borrower has an unusually high amount of unearned income, their loan payments would drop to zero. Borrowers whose only income is from Social Security retirement benefits would have loan payments of zero.

Benefits of Payroll Withholding for Student Loan Payments

This proposal would significantly reduce the need for student loan servicers. Student loan servicers would still be needed for customer service functions, but not as much for collecting loan payments. Moreover, since there would also be a significant reduction in loan defaults, there would no longer be a need for most student loan collection agencies.

Automated payroll withholding of student loan payments would be better for borrowers who otherwise would default, since it avoids the financial ruin that accompanies default.

The federal government and borrowers would save about $1 billion a year in collection costs.

The Right to Default on Student Loans

Some public policy proponents have argued, in effect, that borrowers sometimes need the flexibility to choose to default on their student loans. They criticize payroll withholding of student loan payments as prioritizing student loan payments ahead of other expenses, leaving the borrower with insufficient income to cover basic living expenses, such as food, rent, utilities and medical care.

This argument overlooks the fact that the loan payment under income-driven repayment is a percentage of discretionary income, which subtracts 150% of the poverty line from income. The protected portion of income should be sufficient to cover the cost of basic living expenses. Plus, the borrower is still level with 90% of discretionary income.

The argument is also specious because a borrower who defaults on their federal student loans will be subject to administrative wage garnishment (AWG), which is greater than the amount that is withheld under the income-driven repayment plan.

- Administrative wage garnishment withholds 15% of wages. The borrower must be left with at least 30 times the federal minimum wage per week.

- Income-driven repayment withholds 10% of discretionary income.

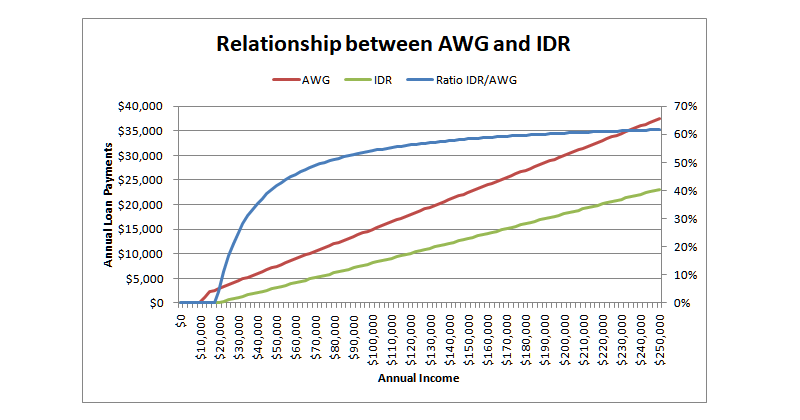

This chart compares the total annual payments under administrative wage garnishment with the total annual payments under income-driven repayment, for a family size of 1 and a federal minimum wage of $7.25 per hour.

As this chart demonstrates, the amount withheld under administrative wage garnishment is always less than the amount withheld under income-driven repayment. The payments under income-driven repayment are less than half of the payments under administrative wage garnishment for incomes up to $75,000 and less than 60% for incomes up to $200,000.

For income less than $50,000, the loan payments under income-driven repayment represent less than 6.3% of income. This increases to less than 8.1% of income for income between $50,000 and $99,999 and to less than 9.3% of income for income between $100,000 and $250,000. That is much less than the 15% of income required under administrative wage garnishment.