A debt-to-income ratio is the percentage of gross monthly income that is used to repay debt, such as student loans, credit cards, auto loans and home mortgages.

The debt-to-income ratio (DTI) is a measure of the borrower’s financial health.

A low debt-to-income ratio indicates that you can afford to repay their loans without experiencing severe financial stress. A high debt-to-income ratio may mean that you are over-extended and do not have sufficient income to repay your loans.

Two Types of Debt-to-Income Ratios

There are actually two different types of debt-to-income ratios.

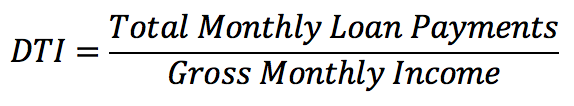

Strictly speaking, the term “debt-to-income ratio” is supposed to mean the ratio of total debt to annual income. But, the debt-to-income ratio has come to defined as a payment ratio, which is the ratio of monthly loan payments to gross monthly income. It is also known as a debt-service-to-income ratio.

For example, the rule of thumb that total student loan debt at graduation should be less than your annual income is the equivalent of a traditional debt-to-income ratio less than 100%. Depending on the interest rate and repayment term, this is the equivalent of a payment ratio of 10% to 15%.

In this article, the term “debt-to-income ratio” refers to a payment ratio.

Do not confuse the debt-to-income ratio with your credit utilization ratio, which is sometimes called a debt-to-limit ratio. The credit utilization ratio is the percentage of available credit that is currently in use. It is the ratio of outstanding debt to the credit limits. The credit utilization ratio is used with revolving debt, such as credit cards, to determine if you are maxing out your credit cards. Lenders like to see a credit utilization ratio that is 6% or less.

The U.S. Department of Education’s gainful employment rules were based on two different types of debt-to-income ratios. One was a payment ratio that compared monthly loan payments to monthly income. The other compared monthly loan payments to discretionary income.

How Do Lenders Use the Debt-to-Income Ratio?

Lenders prefer borrowers who have a low debt-to-income ratio. A lower debt-to-income ratio increases the amount you can afford to borrow. Reducing your debt-to-income ratio can increase your eligibility for a private student loan.

The debt-to-income ratio is unrelated to your credit scores. Your credit history does not include your income, so your debt-to-income ratio does not appear in your credit reports. Rather, lenders calculate your debt-to-income ratio themselves using the information on your loan application and your credit history. They combine the debt-to-income ratio with credit scores, minimum income thresholds and other factors to determine your eligibility for a loan.

What is a Good Debt-to-Income Ratio?

A low debt-to-income ratio is better, when seeking a new loan, because it means you can afford to repay more debt than someone with a high debt-to-income ratio.

For student loans, it is best to have a student loan debt-to-income ratio that is under 10%, with a stretch limit of 15% if you do not have many other types of loans. Your total student loan debt should be less than your annual income.

When refinancing student loans, most lenders will not approve a private student loan if your debt-to-income ratio for all debt payments is more than 50%.

Keep in mind that refinancing federal loans means a loss in many benefits – income-driven repayment plans, any federal loan forgiveness opportunities, generous deferment options, and more.

When borrowing a mortgage, most mortgage lenders consider two debt-to-income ratios, one for mortgage debt payments and one for all recurring debt payments, expressed as a percentage of gross monthly income. The recurring debt payments include credit card payments, auto loans and student loans, in addition to mortgage payments.

Typically, the limits are 28% for mortgage debt and 36% for all debt. The maximum debt-to-income ratios are 31% and 43%, respectively, for FHA mortgages, and 45% and 49% for Fannie Mae and Freddie Mac.

So, borrowing or cosigning a student loan can affect your ability to get a mortgage.

How to Calculate

To calculate your debt-to-income ratio, follow these steps.

- Calculate your total monthly loan payments by adding them together. Look on your credit reports for your monthly loan payments.

- Divide the total monthly loan payments by your gross monthly income. Calculate your gross monthly income by dividing your annual salary by 12.

- Express the resulting ratio as a percentage.

This is the formula for calculating your debt-to-income ratio.

For example, suppose you owe $30,000 in student loan debt with a 5% interest rate and a 10-year repayment term. Your monthly student loan payment will be $318.20. If your annual income is $48,000, your gross monthly income will be $4,000. Then, your debt-to-income ratio is $318.20 / $4,000 = 7.96%, or about 8%.

If you switch to a 20-year repayment term, your monthly student loan payment will drop to $197.99. This will cause your debt-to-income ratio to drop to 4.95%, or about 5%.

How to Reduce Your Debt-to-Income Ratio

Fundamentally, reducing your debt-to-income ratio involves reducing your loan payments and increasing your income.

With student loans, you can reduce your monthly loan payment by choosing a repayment plan with a longer repayment term, such as extended repayment or income-driven repayment.

Other options include aggressively paying down your debt, qualifying for student loan forgiveness and refinancing to get a lower interest rate and a lower monthly loan payment.

Do not cosign loans, because a cosigned loan counts as though it were your loan on your credit reports.

Cut your spending and pay for purchases with cash instead of credit. Do not carry a balance on your credit cards. Do not get more credit cards. Delay any large purchases that may affect your debt-to-income ratio, such as buying a new car.

Follow us on Facebook, Twitter, Instagram, and LinkedIn!