Despite losses within 529 college savings plans and an increase in unemployment due to the Coronavirus pandemic, many families are staying the course on saving for college.

According to a recent Savingforcollege.com survey, two-thirds of consumers have experienced losses in their 529 college savings plans. More than a quarter have experienced job loss or a decrease in income. Yet, they are reacting calmly to the losses, with most remaining invested with no changes in their investment strategy.

Of the families who are saving for college in a 529 plan:

- Two-thirds (65%) have experienced a decrease in the value of their 529 plan since January 1, 2020

- 8% have experienced an increase

- 8% have experienced no change

- 19% are not sure or don’t know

Grandparents are more likely to have experienced an increase in the value of their 529 plans than parents.

Loss of Jobs and Confidence

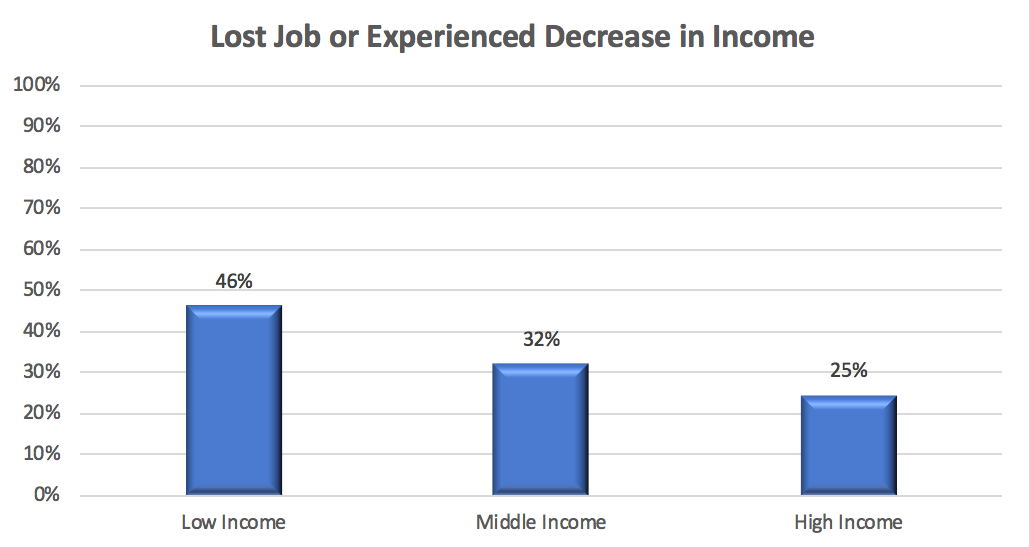

More than a quarter (28%) of families who are saving for college have lost their job or experienced a decrease in income since January 1, 2020. This compares with 39% of families who have not yet opened a 529 plan account. Low-income families are more likely to have lost their job or experienced a decrease in income, as shown in this chart.

More than 26 million Americans filed for unemployment insurance benefits in 2020 as of the date of the survey, according to the Bureau of Labor Statistics (BLS).

A third (33%) of families are less confident now, as compared with the start of the year, that they can reach their college savings goals, 3% are more confident and two-thirds (64%) feel about the same.

Among grandparents, three quarters (74%) feel about the same. More than 40% of low-income families are less confident now.

Reactions to the Economic Downturn

Most families have not made any drastic changes in their 529 college savings plans in reaction to the economic downturn. This is a more muted response than during the 2008 economic downturn, despite the greater financial impact of the coronavirus pandemic.

In response to the market downturn:

- 93% of families have not made any changes to their asset allocation

- 6% have shifted to more conservative investments

- 2% have shifted to more aggressive investments

Families are more likely to make changes to their contributions. Three quarters of families have not made any changes to their contributions, but 12% have stopped making contributions, 4% have decreased their contributions and almost 10% have increased their contributions.

Low-income families are more likely to have stopped making contributions, with a quarter (24%) stopping contributions, compared with 15% of middle-income families and 11% of high-income families.

About 14% have delayed taking a distribution from their 529 plan, representing the majority of families with college-age children. They are waiting for the stock market to recover, even though many are invested in age-based asset allocations and thus have very little exposure to equities.

Almost 2% of families have taken or are thinking of taking a non-qualified distribution.

Only 0.6% of families have liquidated their 529 plans since the mid-February start of the economic downturn.

Of families who have not started saving for college or who are not saving in a 529 plan, 41% have delayed opening a 529 plan because of stock market volatility since mid-February, but three quarters (76%) expect to open a 529 plan account in the future. Almost half (46%) of these families were saving in an account other than a 529 plan, and of these, more than half (54%) have stopped making contributions or are contributing less.

Financial professionals report that only 1 in 8 of their clients are less interested in saving for college because of the economic downturn, with a similar number expressing more interest in saving for college.

Background Data

The survey was conducted from April 17, 2020 to April 21, 2020, with 1,754 responses. The survey is reflective of visitors to the Savingforcollege.com web site and includes people with a strong interest in saving for college.

Most of the respondents (92%) have already started saving for college. Of those who are saving for college, 92% are saving in a 529 college savings plan. Thus, 85% of respondents are saving for college in a 529 plan.

The survey respondents include a mix of parents, grandparents and great grandparents, as well as aunts and uncles.

- More than three quarters (77.6%) are saving for children

- A sixth (16.5%) are saving for grandchildren

- 0.9% for nieces and nephews

- 0.9% for themselves

- 0.2% for great grandchildren

A third of the survey respondents are saving for one child, almost half (46%) for two children and about a fifth (22%) for three or more children. Grandparents are more than twice as likely to be saving for three or more children than parents (45% vs. 17%).

Among survey respondents, more than a quarter are saving for a child age 1-5 (26%), a fifth for a child age 6-11 (20%), and almost a third for a child age 12-17 (29%). In addition, 14% are saving for an unborn or newborn child and 10% for a child age 18 or older. Grandparents are 25% more likely to be saving for a child age 5 and under and parents are more likely to be saving for a child age 12 and older.

The geographic distribution of college savers largely followed the most populous states for college student enrollment, with more than half hailing from California, New York, Texas, Pennsylvania, New Jersey, Illinois, Massachusetts, Florida, Maryland and Ohio.

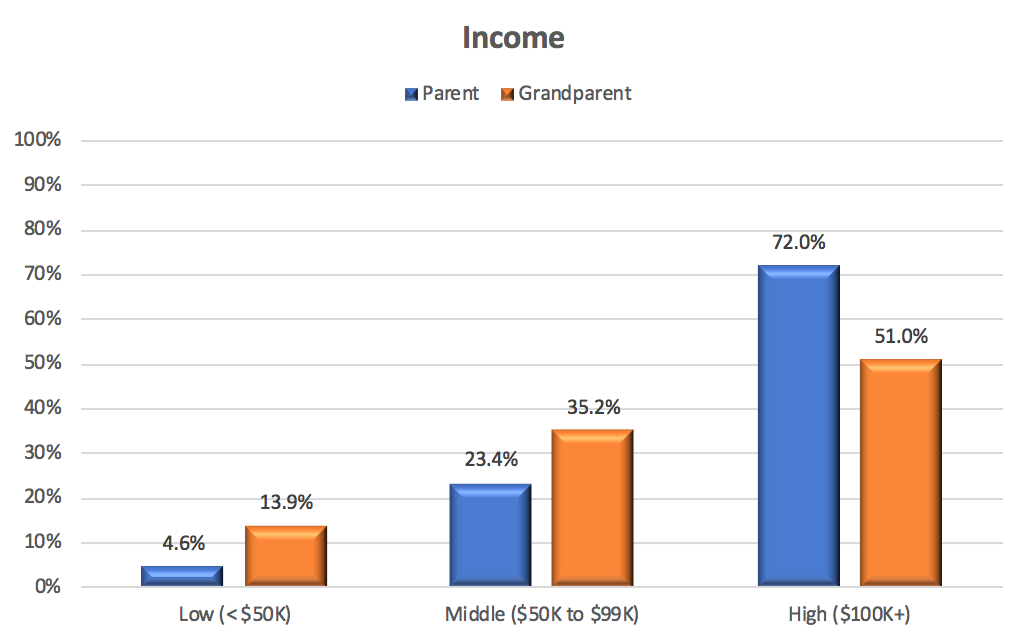

Overall, 6% of savers had income under $50,000, a quarter (25%) had income of $50,000 to $99,999, and more than two-thirds (69%) had income of $100,000 or more. Parents tended to be wealthier than grandparents, as shown in this chart.