Almost every state has at least one 529 plan, and each 529 plan has a unique mix of fees, underlying investments and available benefits. When a 529 plan no longer meets a family’s needs, it might make sense to switch 529 plans by rolling over the funds into a new 529 plan.

The IRS allows one tax-free 529 plan rollover per beneficiary in a 12-month period when the funds are deposited into a new 529 plan within 60 days. However, some states do not follow the federal tax treatment for 529 plan rollovers. Some states treat outbound 529 plan rollovers as non-qualified distributions, subject to state income tax and recapture of any previous state income tax deductions or credits.

Alternatively, some families may choose to keep their funds in an existing 529 plan and direct any new contributions to a new 529 plan. Most 529 plans are available nationwide and can be used to pay for college in any state.

Before you take a withdrawal from your 529 plan be sure to review the steps below to help ensure a smooth rollover process and to minimize tax consequences.

Select a new 529 plan

Families should carefully research and compare their options for a new 529 plan before they enroll:

- To find a 529 plan with better investment performance, review 529 plan performance rankings to see which 529 plan have the best long-term performance

- To find a 529 plan with lower fees, review the 529 plan fee study to see the lowest-cost 529 plans

- To find a 529 plan with a better selection of investments, review the investment options offered by each 529 plan

- If you are moving to a new state, find out if the new state offers a state income tax deduction or credit for incoming 529 plan rollover contributions

- Complete an application online to open a direct-sold 529 plan, or contact a financial advisor to open an advisor-sold 529 plan

Decide whether to do a direct rollover or an indirect rollover

Families may switch 529 plans by completing a direct rollover or an indirect rollover.

Direct Rollovers

With a direct rollover, the 529 plan account owner completes a rollover request form provided by the new 529 plan and the administrator of the new 529 plan coordinates the transfer of funds.

You will need the following information to complete a direct rollover form:

For the new 529 plan

- The name and contact information of the 529 plan account owner

- The new 529 plan account number

- The beneficiary’s name

- The last four digits of the beneficiary’s social security number

For the 529 plan account to be rolled over

- The name and account number of the 529 plan

- The name, address and phone number of the 529 plan Program Manager

- The name of the beneficiary, if the beneficiary will be the same, or a new beneficiary

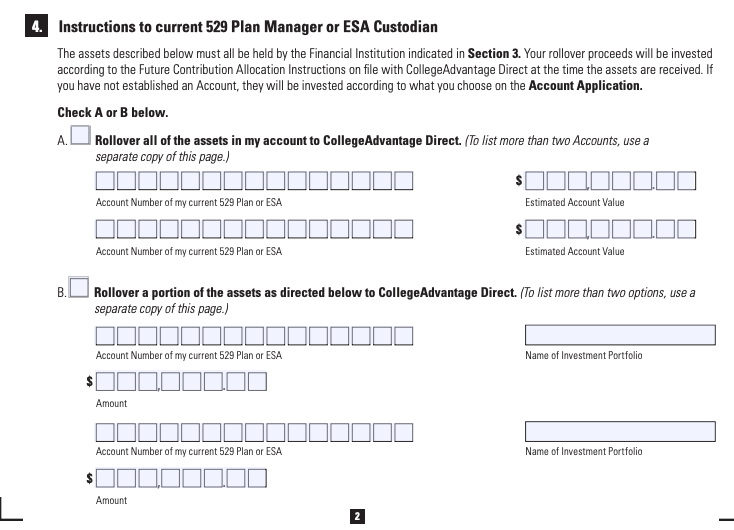

With a direct rollover, the 529 plan account owner must also indicate whether the rollover is a full rollover or a partial rollover. If the rollover is a partial rollover, allocation instructions must be included on the form.

Source: Ohio Tuition Trust Authority

Medallion Signature Guarantee May Be Required

Many 529 plans require the direct rollover form to have a medallion signature guarantee before they will release funds to a new 529 plan. A medallion signature guarantee is a stamp and signature given by a bank, credit union or other financial firm that is a member of a medallion signature guarantee program to confirm your identity.

Medallion signature guarantees are usually necessary when moving assets from one brokerage to another. Generally, the participating financial institution requires you to be a member before they will guarantee your signature.

It’s important to contact your current 529 plan before submitting a direct rollover form to the new 529 plan to ask whether a medallion signature guarantee is needed. Failing to provide a medallion signature guarantee when one is required may delay the rollover process.

Indirect Rollovers

With an indirect rollover, the 529 plan account owner withdraws money from the current 529 plan and deposits the funds into the new 529 plan within 60 days. The 529 plan account owner must indicate that the contribution to the new 529 plan is a rollover contribution, and they must provide a breakdown of the contributions and earnings being rolled over. The rollover contribution can be completed with the enrollment application for the new 529 plan.

If funds are not deposited into a new 529 plan within 60 days, the distribution will be considered non-qualified and the earnings portion of the withdrawal will be subject to income tax and a 10% tax penalty.

If the account owner does not specify the breakdown of the rollover, the entire rollover will be assumed to be earnings.