{{parent.cta_data.text}}

COMMUNITY

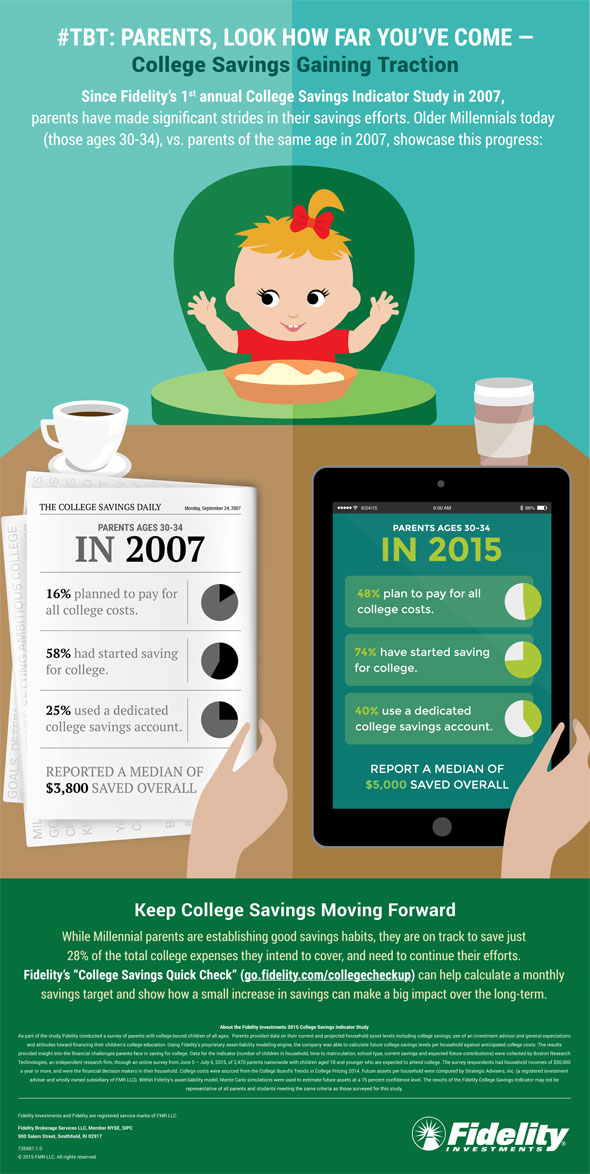

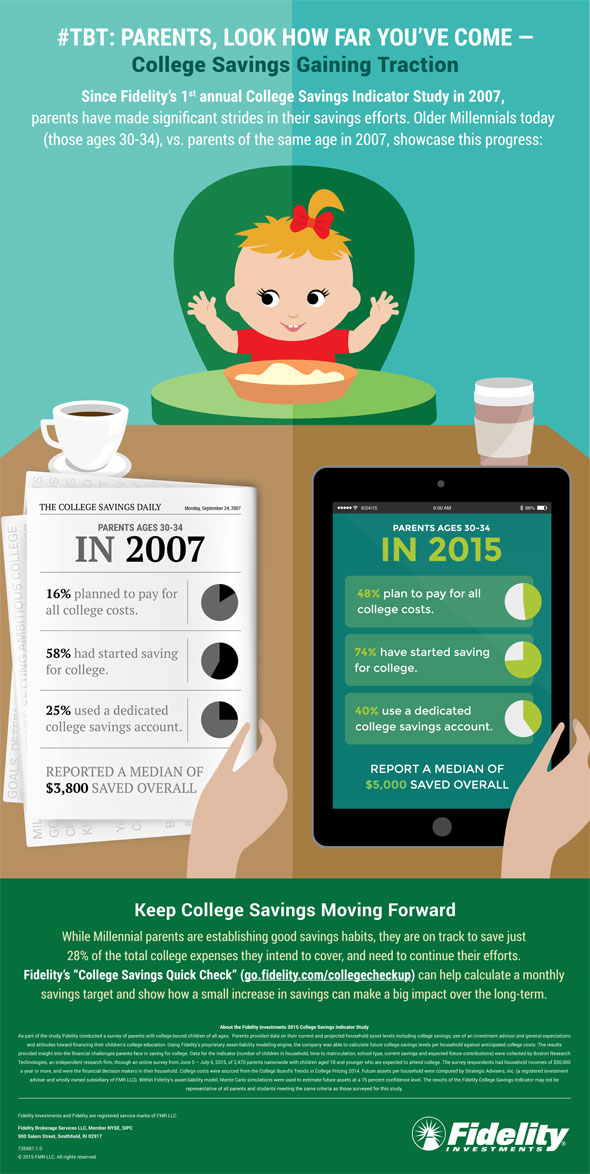

#TBT College savings: Then and Now

http://www.savingforcollege.com/articles/tbt-college-savings--then-and-now-843

Posted: 2015-09-24

For the past nine years, Fidelity's College Savings Indicator Study has revealed just how much American families are putting away for college. This infographic highlights a few key findings. According to the results, today's 30-34 year old parents are much more aware of the importance of planning for future education costs than those were asked in 2007. In fact, about two-thirds have started saving for college, compared to only 58% of families from the very first survey. However, while intentions are good, 2015 parents are only on track to save a mere 28% of the amount of college they intend to cover.

It's possible that some families are unsure about how much they should be saving. In some cities, a degree from a private college can cost more than a family home, which might seem out of reach to a new mom or dad. The important thing is to start saving as much as you can, but also try and develop a realistic goal based on the type of education you want for your child. The sticker price of an Ivy League may leave you feeling helpless, but remember this amount doesn't account for grants, scholarships or tax benefits. If you can aim to save 25% of your projected costs, there are a number of ways to cover the gap when it's time for college.

RELATED: The magic number for college savings

Consider sending your child to a community college for two years. You'll save on tuition and room and board, and they might even be able to work part-time to put away money for their four-year school. And, if you're saving with a 529 plan and your state offers a state tax deduction for contributions, be sure to reinvest them. This also applies to bonuses from work or any other unexpected income. The value will compound over time and since it was extra money you'll never even miss it.

There are also plenty of resources available to help young families get started on the right track. Savingforcollege.com's World's Simplest College Calculator lets you customize a plan based on your school choice, and Fidelity's College Savings Quick Check will help you calculate a monthly target to reach your goal.

RELATED: 76% of families have college funds by first grade

For the past nine years, Fidelity's College Savings Indicator Study has revealed just how much American families are putting away for college. This infographic highlights a few key findings. According to the results, today's 30-34 year old parents are much more aware of the importance of planning for future education costs than those were asked in 2007. In fact, about two-thirds have started saving for college, compared to only 58% of families from the very first survey. However, while intentions are good, 2015 parents are only on track to save a mere 28% of the amount of college they intend to cover.

It's possible that some families are unsure about how much they should be saving. In some cities, a degree from a private college can cost more than a family home, which might seem out of reach to a new mom or dad. The important thing is to start saving as much as you can, but also try and develop a realistic goal based on the type of education you want for your child. The sticker price of an Ivy League may leave you feeling helpless, but remember this amount doesn't account for grants, scholarships or tax benefits. If you can aim to save 25% of your projected costs, there are a number of ways to cover the gap when it's time for college.

RELATED: The magic number for college savings

Consider sending your child to a community college for two years. You'll save on tuition and room and board, and they might even be able to work part-time to put away money for their four-year school. And, if you're saving with a 529 plan and your state offers a state tax deduction for contributions, be sure to reinvest them. This also applies to bonuses from work or any other unexpected income. The value will compound over time and since it was extra money you'll never even miss it.

There are also plenty of resources available to help young families get started on the right track. Savingforcollege.com's World's Simplest College Calculator lets you customize a plan based on your school choice, and Fidelity's College Savings Quick Check will help you calculate a monthly target to reach your goal.

RELATED: 76% of families have college funds by first grade

If you liked this post and think it would help others save for college, please share!

Recommended Articles

SPONSOR CONTENT

Financial Professionals

Top 529 College Savings Plans

One-year rankings are based on a plan's average investment returns over the last 12 months.

| State | Plan Name | |

|---|---|---|

| 1 | Nevada | USAA 529 Education Savings Plan |

| 2 | Florida | Florida 529 Savings Plan |

| 3 | New Jersey | NJBEST 529 College Savings Plan |

Three-year rankings are based on a plan's average annual investment returns over the last three years.

| State | Plan Name | |

|---|---|---|

| 1 | South Dakota | CollegeAccess 529 (Direct-sold) |

| 2 | Wisconsin | Edvest 529 |

| 3 | Nevada | USAA 529 Education Savings Plan |

Five-year rankings are based on a plan's average annual investment returns over the last five years

| State | Plan Name | |

|---|---|---|

| 1 | Indiana | CollegeChoice 529 Direct Savings Plan |

| 2 | Florida | Florida 529 Savings Plan |

| 3 | Alaska | T. Rowe Price College Savings Plan |

10-year rankings are based on a plan's average annual investment returns over the last ten years.

| State | Plan Name | |

|---|---|---|

| 1 | West Virginia | SMART529 WV Direct College Savings Plan |

| 2 | South Carolina | Future Scholar 529 College Savings Plan (Direct-sold) |

| 3 | Ohio | Ohio's 529 Plan, CollegeAdvantage |

{{parent.title}}

{{parent.title}}

Login

Login