{{parent.cta_data.text}}

COMMUNITY

The 2014 Annual College Savings Survey Results

http://www.savingforcollege.com/articles/2014-annual-college-savings-survey-results

Posted: 2014-03-11

As the countryís leading independent source of information on college savings, savingforcollege.com aims to provide our guests with insightful and relevant content that will guide them closer toward their savings goals. We recently conducted our first Annual College Savings Survey, which was designed to help shed light on consumer awareness, beliefs, misconceptions, purchase criteria and more, in relation to 529 plans. With responses from 2,000+ participants, the results uncovered a number of key findings that we are excited to share with our readers in a series of blog posts over the next three weeks.

Download the College Savings Survey PDF Report!

Savers may be missing out

According to the Annual College Savings Survey, 70 percent of the respondents did not currently have a 529 plan. Among this group, many (70%) had not even started saving for college. The number one reason for being a non-saver was that they havenít had time to research and/or understand the best options. This immediately caught our attention. As an industry leader, we have researched and collected facts related to 529 plans and various other ways of funding higher education expenses. Our site offers free resources like plan performance rankings, savings calculators and a directory of professional advisors just to name a few. Could there be a more efficient way for us to share our knowledge to encourage more non-savers to start saving today? Additionally, we uncovered that only 31 percent of those with 529 plans are utilizing their full potential by contributing the total amount they are saving for college. To address this, our first blog post will focus on the tax savings you may be missing out on by investing in other savings vehicles versus a 529 plan.

Direct- vs. Advisor-sold?

Those who wish to start saving have the choice of purchasing a 529 plan directly or enlisting the help of a professional financial advisor. A financial advisor can be a useful resource in finding the perfect plan, but they do come at a price. The Annual College Savings Survey revealed that most participants have not/would not seek advice from a professional and they are comfortable selecting their own investments. Many are also concerned about paying commissions and other fees that may be associated. It seems to us that our readers may not fully understand the benefits of working with an advisor. Our next blog post will highlight what you can expect from working with a professional versus selecting a plan on your own.

Increased grandparent interest

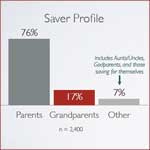

The Annual College Savings Survey also confirmed that in addition to parents saving for their own children, we are also beginning to see a growing number of non-traditional college savers like grandparents, godparents, aunts and uncles. We are particularly interested in grandparents, who made up a significant portion of the respondents (16.8%).

Grandparents have their own worries when it comes to helping pay for their grandchildrenís education. Many witnessed their retirement account balances dwindle in recent years and are concerned with being able to maintain their lifestyle. That being said, they also understand the value of higher education and that costs are on the rise.

Grandparents have their own worries when it comes to helping pay for their grandchildrenís education. Many witnessed their retirement account balances dwindle in recent years and are concerned with being able to maintain their lifestyle. That being said, they also understand the value of higher education and that costs are on the rise.

We want to keep grandparents informed of the unique benefits a 529 plan can offer, such as being able to remove the money invested in the plan from their estate to reduce estate taxes. The study allowed us to delve deeper into the thoughts and opinions of grandparents and their views on saving for college, which will be the topic of our third blog in this series.

Clearing up the confusion

Since the launch of the first 529 plans in 1996, many people have been confused about their functionality. The Annual College Savings Survey presented six common misconceptions and asked readers whether they believed them to be true or false. We found the largest discrepancies in the questions regarding the effects on financial aid eligibility (64% believed 529 plan savings are considered when determining eligibility) and childrenís rights to withdraw money from a 529 account (61% believed a child can never withdraw without a parentís permission). This was not surprising to us, considering the answers may vary depending on the situation. The final two blogs in the series will help dispel these myths and help clear up other grey areas, such as state requirements and what happens to funds when a child doesnít go to college or gets a scholarship.

Whether or not our respondents were saving for college at the time they took the survey, we know it was on their minds. We appreciate the help of all who participated and look forward to continuing this study on an annual basis. Stay tuned over the coming weeks for more insights related to this yearís results!

Interested in more in-depth results? Download the full survey report here.

As the countryís leading independent source of information on college savings, savingforcollege.com aims to provide our guests with insightful and relevant content that will guide them closer toward their savings goals. We recently conducted our first Annual College Savings Survey, which was designed to help shed light on consumer awareness, beliefs, misconceptions, purchase criteria and more, in relation to 529 plans. With responses from 2,000+ participants, the results uncovered a number of key findings that we are excited to share with our readers in a series of blog posts over the next three weeks.

Download the College Savings Survey PDF Report!

Savers may be missing out

According to the Annual College Savings Survey, 70 percent of the respondents did not currently have a 529 plan. Among this group, many (70%) had not even started saving for college. The number one reason for being a non-saver was that they havenít had time to research and/or understand the best options. This immediately caught our attention. As an industry leader, we have researched and collected facts related to 529 plans and various other ways of funding higher education expenses. Our site offers free resources like plan performance rankings, savings calculators and a directory of professional advisors just to name a few. Could there be a more efficient way for us to share our knowledge to encourage more non-savers to start saving today? Additionally, we uncovered that only 31 percent of those with 529 plans are utilizing their full potential by contributing the total amount they are saving for college. To address this, our first blog post will focus on the tax savings you may be missing out on by investing in other savings vehicles versus a 529 plan.

Direct- vs. Advisor-sold?

Those who wish to start saving have the choice of purchasing a 529 plan directly or enlisting the help of a professional financial advisor. A financial advisor can be a useful resource in finding the perfect plan, but they do come at a price. The Annual College Savings Survey revealed that most participants have not/would not seek advice from a professional and they are comfortable selecting their own investments. Many are also concerned about paying commissions and other fees that may be associated. It seems to us that our readers may not fully understand the benefits of working with an advisor. Our next blog post will highlight what you can expect from working with a professional versus selecting a plan on your own.

Increased grandparent interest

The Annual College Savings Survey also confirmed that in addition to parents saving for their own children, we are also beginning to see a growing number of non-traditional college savers like grandparents, godparents, aunts and uncles. We are particularly interested in grandparents, who made up a significant portion of the respondents (16.8%).

Grandparents have their own worries when it comes to helping pay for their grandchildrenís education. Many witnessed their retirement account balances dwindle in recent years and are concerned with being able to maintain their lifestyle. That being said, they also understand the value of higher education and that costs are on the rise.

Grandparents have their own worries when it comes to helping pay for their grandchildrenís education. Many witnessed their retirement account balances dwindle in recent years and are concerned with being able to maintain their lifestyle. That being said, they also understand the value of higher education and that costs are on the rise.

We want to keep grandparents informed of the unique benefits a 529 plan can offer, such as being able to remove the money invested in the plan from their estate to reduce estate taxes. The study allowed us to delve deeper into the thoughts and opinions of grandparents and their views on saving for college, which will be the topic of our third blog in this series.

Clearing up the confusion

Since the launch of the first 529 plans in 1996, many people have been confused about their functionality. The Annual College Savings Survey presented six common misconceptions and asked readers whether they believed them to be true or false. We found the largest discrepancies in the questions regarding the effects on financial aid eligibility (64% believed 529 plan savings are considered when determining eligibility) and childrenís rights to withdraw money from a 529 account (61% believed a child can never withdraw without a parentís permission). This was not surprising to us, considering the answers may vary depending on the situation. The final two blogs in the series will help dispel these myths and help clear up other grey areas, such as state requirements and what happens to funds when a child doesnít go to college or gets a scholarship.

Whether or not our respondents were saving for college at the time they took the survey, we know it was on their minds. We appreciate the help of all who participated and look forward to continuing this study on an annual basis. Stay tuned over the coming weeks for more insights related to this yearís results!

Interested in more in-depth results? Download the full survey report here.

If you liked this post and think it would help others save for college, please share!

Recommended Articles

SPONSOR CONTENT

Financial Professionals

Top 529 College Savings Plans

One-year rankings are based on a plan's average investment returns over the last 12 months.

| State | Plan Name | |

|---|---|---|

| 1 | Nevada | USAA 529 Education Savings Plan |

| 2 | Florida | Florida 529 Savings Plan |

| 3 | New Jersey | NJBEST 529 College Savings Plan |

Three-year rankings are based on a plan's average annual investment returns over the last three years.

| State | Plan Name | |

|---|---|---|

| 1 | South Dakota | CollegeAccess 529 (Direct-sold) |

| 2 | Wisconsin | Edvest 529 |

| 3 | Nevada | USAA 529 Education Savings Plan |

Five-year rankings are based on a plan's average annual investment returns over the last five years

| State | Plan Name | |

|---|---|---|

| 1 | Indiana | CollegeChoice 529 Direct Savings Plan |

| 2 | Florida | Florida 529 Savings Plan |

| 3 | Alaska | T. Rowe Price College Savings Plan |

10-year rankings are based on a plan's average annual investment returns over the last ten years.

| State | Plan Name | |

|---|---|---|

| 1 | West Virginia | SMART529 WV Direct College Savings Plan |

| 2 | South Carolina | Future Scholar 529 College Savings Plan (Direct-sold) |

| 3 | Ohio | Ohio's 529 Plan, CollegeAdvantage |

{{parent.title}}

{{parent.title}}

Login

Login