{{parent.cta_data.text}}

COLLEGE SAVINGS 101

Annual College Savings Survey results: Make the most of your savings

http://www.savingforcollege.com/articles/make-the-most-of-your-savings

Posted: 2014-03-18

As promised, here is the first in a series of blog posts based on the results of our Annual College Savings Survey. We’d like to begin by examining how our readers are currently saving for college and why. Out of the 2,000+ respondents, 30 percent were using a 529 plan. What really grabbed our attention was that of those who had a 529 plan only 30 percent were using it to invest their total amount saved for college. The other 70 percent were allocating their funds among other savings vehicles. This led us to wonder why more of our readers were not utilizing the full potential of their 529 plans. When used solely for the purpose of paying for higher education, 529 plans offer some pretty great benefits that you won’t find anywhere else.

Tax Benefits

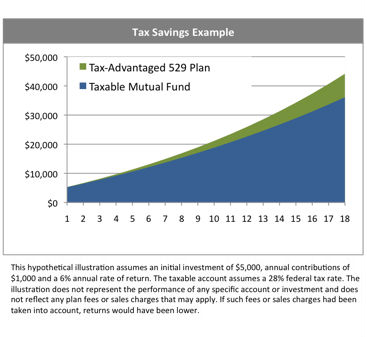

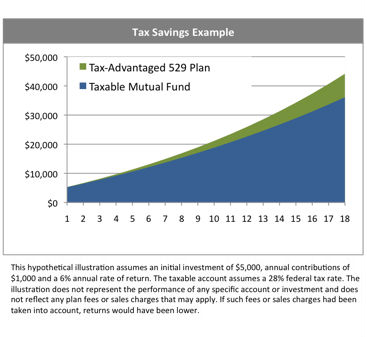

First and foremost, 529 college savings plans offer federal tax advantages that, over time, can help boost your account balance significantly. Investment options like mutual funds will give up a large portion of their earnings to annual income taxes. Earnings in a 529 plan, however, grow tax-free over the entire life of the plan. What’s more, when shares are sold mutual fund investors are hit with a capital gains tax. The chart below illustrates the potential savings offered by a 529 plan versus a mutual fund over 18 years, with an initial investment of $5,000 and an annual contribution of $1,000.

When the time for college arrives, the 529 plan has a balance of $44,177 but after paying taxes the mutual fund account is left with only $36,177.

When the time for college arrives, the 529 plan has a balance of $44,177 but after paying taxes the mutual fund account is left with only $36,177.

U.S. savings bonds may also offer federal tax benefits if they are used for qualified education expenses, but investors must meet a number of criteria including income limits.

Most 529 plans also offer state tax incentives for residents. Today, almost all states will exclude earnings in a 529 account from state and local income taxes. Many also offer their residents a deduction or tax credit for contributions to the plan they operate. Before you invest, research your state’s plan to make sure you don’t miss out on any other potential benefits.

Find out more about the 529 plan tax benefits in your state.

For those who are concerned with estate and gift taxes, 529 plan contributions are treated as completed, present-interest gifts to the beneficiary. This means that the money comes out of your taxable estate, and the gifts qualify for the $14,000 annual gift tax exclusion. This is important to keep in mind if you are thinking about saving for college through a trust. Trusts can often be costly and complicated to set up, and transferring assets may have negative gift tax consequences.

Flexibility

While many tax breaks come with income limitations as mentioned above, 529 plans are available to all income levels and in many cases allow individual contributions of over $300,000 per year. Keep this in mind if you are considering a Coverdell ESA. This type of account is only offered to individuals with a modified gross adjusted income of less than $110,000 ($220,000 if filing a joint return), and imposes an annual contribution limit of only $2,000.

Learn more about how a Coverdell ESA works.

Although 529 plan contributions are treated as completed gifts for tax purposes, the account owner retains control of the account. This is a common concern for parents and guardians who set up custodial accounts (established under either the Uniform Transfers to Minors Act (UTMA) or the Uniform Gifts to Minors Act (UGMA)), which give the child complete control of the assets in the account once he or she is no longer considered a minor. With a 529 plan, parents remain in charge and can even change the beneficiary or revoke the assets at any time.

529 plans also offer many options to suit different investment objectives and risk profiles. For example, you may select a plan that focuses on keeping up with increasing tuition costs. Others may feel more comfortable with a plan that automatically allocates funds among different types of investments based on a time horizon. There are even 529 plans that offer a menu of stock and bond funds to choose from. This is another advantage over U.S savings bonds, which are strictly a fixed-income investment.

The Sensible Choice

Fortunately, there are many options available for those who wish to open an account dedicated to college savings. In many cases, 529 plans offer the most valuable benefits. If you are one of the 70 percent who is supplementing your 529 plan with another savings vehicle, you could be missing out.

How are you allocating your college savings funds? Why is or isn't it working for you?

Don't miss the other posts in this series!

As promised, here is the first in a series of blog posts based on the results of our Annual College Savings Survey. We’d like to begin by examining how our readers are currently saving for college and why. Out of the 2,000+ respondents, 30 percent were using a 529 plan. What really grabbed our attention was that of those who had a 529 plan only 30 percent were using it to invest their total amount saved for college. The other 70 percent were allocating their funds among other savings vehicles. This led us to wonder why more of our readers were not utilizing the full potential of their 529 plans. When used solely for the purpose of paying for higher education, 529 plans offer some pretty great benefits that you won’t find anywhere else.

Tax Benefits

First and foremost, 529 college savings plans offer federal tax advantages that, over time, can help boost your account balance significantly. Investment options like mutual funds will give up a large portion of their earnings to annual income taxes. Earnings in a 529 plan, however, grow tax-free over the entire life of the plan. What’s more, when shares are sold mutual fund investors are hit with a capital gains tax. The chart below illustrates the potential savings offered by a 529 plan versus a mutual fund over 18 years, with an initial investment of $5,000 and an annual contribution of $1,000.

When the time for college arrives, the 529 plan has a balance of $44,177 but after paying taxes the mutual fund account is left with only $36,177.

When the time for college arrives, the 529 plan has a balance of $44,177 but after paying taxes the mutual fund account is left with only $36,177.

U.S. savings bonds may also offer federal tax benefits if they are used for qualified education expenses, but investors must meet a number of criteria including income limits.

Most 529 plans also offer state tax incentives for residents. Today, almost all states will exclude earnings in a 529 account from state and local income taxes. Many also offer their residents a deduction or tax credit for contributions to the plan they operate. Before you invest, research your state’s plan to make sure you don’t miss out on any other potential benefits.

Find out more about the 529 plan tax benefits in your state.

For those who are concerned with estate and gift taxes, 529 plan contributions are treated as completed, present-interest gifts to the beneficiary. This means that the money comes out of your taxable estate, and the gifts qualify for the $14,000 annual gift tax exclusion. This is important to keep in mind if you are thinking about saving for college through a trust. Trusts can often be costly and complicated to set up, and transferring assets may have negative gift tax consequences.

Flexibility

While many tax breaks come with income limitations as mentioned above, 529 plans are available to all income levels and in many cases allow individual contributions of over $300,000 per year. Keep this in mind if you are considering a Coverdell ESA. This type of account is only offered to individuals with a modified gross adjusted income of less than $110,000 ($220,000 if filing a joint return), and imposes an annual contribution limit of only $2,000.

Learn more about how a Coverdell ESA works.

Although 529 plan contributions are treated as completed gifts for tax purposes, the account owner retains control of the account. This is a common concern for parents and guardians who set up custodial accounts (established under either the Uniform Transfers to Minors Act (UTMA) or the Uniform Gifts to Minors Act (UGMA)), which give the child complete control of the assets in the account once he or she is no longer considered a minor. With a 529 plan, parents remain in charge and can even change the beneficiary or revoke the assets at any time.

529 plans also offer many options to suit different investment objectives and risk profiles. For example, you may select a plan that focuses on keeping up with increasing tuition costs. Others may feel more comfortable with a plan that automatically allocates funds among different types of investments based on a time horizon. There are even 529 plans that offer a menu of stock and bond funds to choose from. This is another advantage over U.S savings bonds, which are strictly a fixed-income investment.

The Sensible Choice

Fortunately, there are many options available for those who wish to open an account dedicated to college savings. In many cases, 529 plans offer the most valuable benefits. If you are one of the 70 percent who is supplementing your 529 plan with another savings vehicle, you could be missing out.

How are you allocating your college savings funds? Why is or isn't it working for you?

Don't miss the other posts in this series!

If you liked this post and think it would help others save for college, please share!

Recommended Articles

SPONSOR CONTENT

Financial Professionals

Top 529 College Savings Plans

One-year rankings are based on a plan's average investment returns over the last 12 months.

| State | Plan Name | |

|---|---|---|

| 1 | Nevada | USAA 529 Education Savings Plan |

| 2 | Florida | Florida 529 Savings Plan |

| 3 | New Jersey | NJBEST 529 College Savings Plan |

Three-year rankings are based on a plan's average annual investment returns over the last three years.

| State | Plan Name | |

|---|---|---|

| 1 | South Dakota | CollegeAccess 529 (Direct-sold) |

| 2 | Wisconsin | Edvest 529 |

| 3 | Nevada | USAA 529 Education Savings Plan |

Five-year rankings are based on a plan's average annual investment returns over the last five years

| State | Plan Name | |

|---|---|---|

| 1 | Indiana | CollegeChoice 529 Direct Savings Plan |

| 2 | Florida | Florida 529 Savings Plan |

| 3 | Alaska | T. Rowe Price College Savings Plan |

10-year rankings are based on a plan's average annual investment returns over the last ten years.

| State | Plan Name | |

|---|---|---|

| 1 | West Virginia | SMART529 WV Direct College Savings Plan |

| 2 | South Carolina | Future Scholar 529 College Savings Plan (Direct-sold) |

| 3 | Ohio | Ohio's 529 Plan, CollegeAdvantage |

{{parent.title}}

{{parent.title}}

Login

Login