{{parent.cta_data.text}}

STUDENT LOANS

5 characteristics of high school students heading to college

http://www.savingforcollege.com/articles/5-characteristics-of-high-school-students-heading-to-college-795

Posted: 2015-06-24

Last month, the College Savings Foundation (CSF) published results from their sixth annual “How Youth Plan to Pay for College” survey. Their findings show that just as in previous years, the majority of high school sophomores, juniors and seniors believe they should help pay for at least some of their college education. But this year more students are concerned about the price of college and many are trying to avoid student loans. Here’s why and how:

They fear debt

Congratulations to the Class of 2014 - you no longer hold the “most indebted class ever” spot. This year’s Class of 2015 broke the record, with students leaving college with an average loan balance of just over $35,000, according to Mark Kantrowitz, founder of Edvisors. Today’s high school students are well aware of the dire effects that can result from this type of debt, and it’s having a major impact on their college decision-making. According to the CFS study, 84 percent of students who might take out loans for school are concerned about how they will pay them back. What’s more, the number of students who intend on borrowing to pay for college has gone down quite a bit since last year (55% versus 72%).

They shop around for deals

For many high school students, the allure of a private college begins to fade once they realize how much it actually costs. A high school sophomore who wants to go to a 4-year private university will be looking at a total cost of around $213,000, according to data from the College Board. Perhaps that’s why more students are leaning toward community college (19%) than private college (16%). In fact, according to CSF, 61 percent of students switched to a community college this year because of costs. It’s also interesting to note the changes in perceptions of different types of higher education. Last year’s survey revealed that only 21 percent of students thought of career and vocational schools in the same way as traditional colleges. This year, that number doubled to 42 percent. Yet despite the cost savings only 5 percent of those surveyed plan on attending a career school.

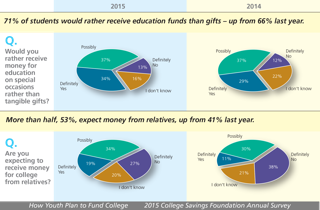

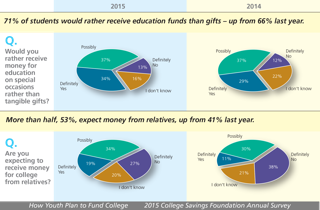

They find sources of funds

The chances of getting a free ride to college these days are pretty slim. In fact, from 2008-2013 a total of 19 states reduced the amount of financial aid they awarded, according to PBS Newshour. Yet 78 percent of the students surveyed by the College Savings Foundation are relying on scholarships to cover at least some of their tuition bills. Relatives are becoming another popular source of college funds. According to the study, 71 percent of students would prefer to receive money for college in lieu of birthday, graduation and holiday gifts. More students are also planning to work during college this year than last year (59% versus 51%), and 23 percent of these working students are willing to give up their full-time student status for their jobs.

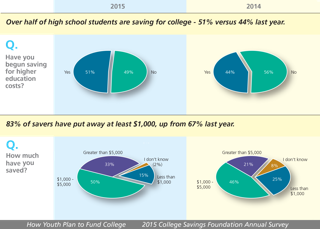

They save

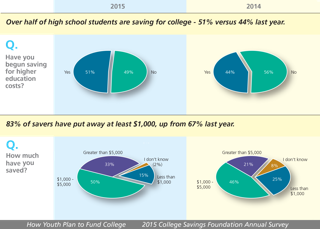

Americans in general are saving more money, according to the Federal Reserve, and high school students are no exception. Last year’s CSF survey revealed that 44 percent of students were already saving for college, but this year that figure jumped to 51 percent. What’s more, 83 percent of these savers have at least $1,000 earmarked for college. Surprisingly, many teens are also bypassing the mall and taking their paychecks to the bank. 40 percent say they would give up material things in order to save more money for college.

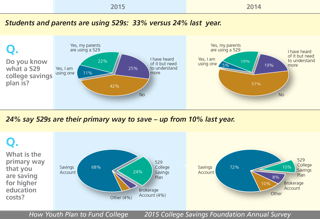

They use 529 plans

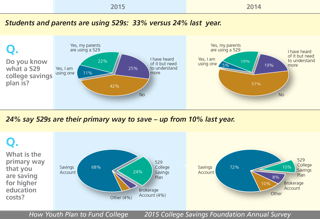

These tax-advantaged investment accounts, which are designed to help families set aside funds for higher education, are continuing to grow in popularity. The money you earn in a 529 account grows tax-free and won’t be taxed when you take a withdrawal to pay for college. Some states also offer special incentives for residents who use their home state’s 529 plan. For example, the Finance Authority of Maine (FAME) offers matching grants for residents who enroll in a NextGen 529 account. A total of 34 states, including Washington D.C., offer residents a state tax deduction or credit for 529 plan contributions. Six of these states will offer the benefit no matter which 529 plan is used. According to the CSF study, the number of families using 529 plans as their primary source of college savings this year has more than doubled since last year (24% versus 10%).

Last month, the College Savings Foundation (CSF) published results from their sixth annual “How Youth Plan to Pay for College” survey. Their findings show that just as in previous years, the majority of high school sophomores, juniors and seniors believe they should help pay for at least some of their college education. But this year more students are concerned about the price of college and many are trying to avoid student loans. Here’s why and how:

They fear debt

Congratulations to the Class of 2014 - you no longer hold the “most indebted class ever” spot. This year’s Class of 2015 broke the record, with students leaving college with an average loan balance of just over $35,000, according to Mark Kantrowitz, founder of Edvisors. Today’s high school students are well aware of the dire effects that can result from this type of debt, and it’s having a major impact on their college decision-making. According to the CFS study, 84 percent of students who might take out loans for school are concerned about how they will pay them back. What’s more, the number of students who intend on borrowing to pay for college has gone down quite a bit since last year (55% versus 72%).

They shop around for deals

For many high school students, the allure of a private college begins to fade once they realize how much it actually costs. A high school sophomore who wants to go to a 4-year private university will be looking at a total cost of around $213,000, according to data from the College Board. Perhaps that’s why more students are leaning toward community college (19%) than private college (16%). In fact, according to CSF, 61 percent of students switched to a community college this year because of costs. It’s also interesting to note the changes in perceptions of different types of higher education. Last year’s survey revealed that only 21 percent of students thought of career and vocational schools in the same way as traditional colleges. This year, that number doubled to 42 percent. Yet despite the cost savings only 5 percent of those surveyed plan on attending a career school.

They find sources of funds

The chances of getting a free ride to college these days are pretty slim. In fact, from 2008-2013 a total of 19 states reduced the amount of financial aid they awarded, according to PBS Newshour. Yet 78 percent of the students surveyed by the College Savings Foundation are relying on scholarships to cover at least some of their tuition bills. Relatives are becoming another popular source of college funds. According to the study, 71 percent of students would prefer to receive money for college in lieu of birthday, graduation and holiday gifts. More students are also planning to work during college this year than last year (59% versus 51%), and 23 percent of these working students are willing to give up their full-time student status for their jobs.

They save

Americans in general are saving more money, according to the Federal Reserve, and high school students are no exception. Last year’s CSF survey revealed that 44 percent of students were already saving for college, but this year that figure jumped to 51 percent. What’s more, 83 percent of these savers have at least $1,000 earmarked for college. Surprisingly, many teens are also bypassing the mall and taking their paychecks to the bank. 40 percent say they would give up material things in order to save more money for college.

They use 529 plans

These tax-advantaged investment accounts, which are designed to help families set aside funds for higher education, are continuing to grow in popularity. The money you earn in a 529 account grows tax-free and won’t be taxed when you take a withdrawal to pay for college. Some states also offer special incentives for residents who use their home state’s 529 plan. For example, the Finance Authority of Maine (FAME) offers matching grants for residents who enroll in a NextGen 529 account. A total of 34 states, including Washington D.C., offer residents a state tax deduction or credit for 529 plan contributions. Six of these states will offer the benefit no matter which 529 plan is used. According to the CSF study, the number of families using 529 plans as their primary source of college savings this year has more than doubled since last year (24% versus 10%).

If you liked this post and think it would help others save for college, please share!

Recommended Articles

SPONSOR CONTENT

Financial Professionals

Top 529 College Savings Plans

One-year rankings are based on a plan's average investment returns over the last 12 months.

| State | Plan Name | |

|---|---|---|

| 1 | Nevada | USAA 529 Education Savings Plan |

| 2 | Florida | Florida 529 Savings Plan |

| 3 | New Jersey | NJBEST 529 College Savings Plan |

Three-year rankings are based on a plan's average annual investment returns over the last three years.

| State | Plan Name | |

|---|---|---|

| 1 | South Dakota | CollegeAccess 529 (Direct-sold) |

| 2 | Wisconsin | Edvest 529 |

| 3 | Nevada | USAA 529 Education Savings Plan |

Five-year rankings are based on a plan's average annual investment returns over the last five years

| State | Plan Name | |

|---|---|---|

| 1 | Indiana | CollegeChoice 529 Direct Savings Plan |

| 2 | Florida | Florida 529 Savings Plan |

| 3 | Alaska | T. Rowe Price College Savings Plan |

10-year rankings are based on a plan's average annual investment returns over the last ten years.

| State | Plan Name | |

|---|---|---|

| 1 | West Virginia | SMART529 WV Direct College Savings Plan |

| 2 | South Carolina | Future Scholar 529 College Savings Plan (Direct-sold) |

| 3 | Ohio | Ohio's 529 Plan, CollegeAdvantage |

{{parent.title}}

{{parent.title}}

Login

Login