The earlier you start to save for college, the better. But, what’s the best parent age to start a 529 plan? The answer will depend on your individual situation. But, for most people, the best time to start saving for college is between the ages of 25 and 34.

Average age of 529 plan account owners

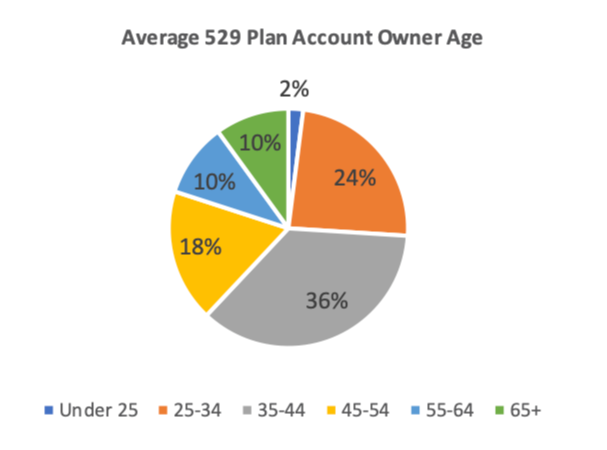

Just about any U.S. citizen who is of legal age (18 in most states) can open a 529 plan. However, according to data from Ascensus, the nation’s largest services provider to college savings plans, the average age of 529 plan account owners when they open a 529 plan is 44 years old.

The average age of first-time mothers is 26.3 years, according to a 2016 report from the CDC. But, data from Ascensus shows that the majority of 529 plan account owners waited until they were at least 35 to open a 529 plan account.

Source: Ascensus, as of 12/05/19

Average 529 plan account balances by age

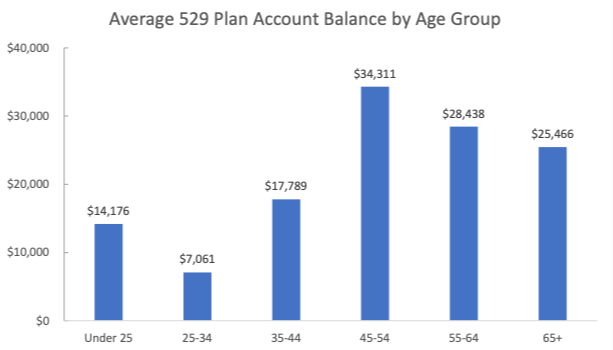

As of December 5, 2019, the average balance of 529 plans on the Ascensus platform was $25,292. 529 plan account owners between the ages of 45 and 54 had the largest average balance ($34,311), and 529 plan account owners between the ages of 25 and 34 had the smallest average balance ($7,061).

Source: Ascensus, 12/05/19

The cost of waiting

Parents who have a child at age 26 and wait until age 44 to start saving for college miss out on 18 years of potential tax-free compounding. Money invested in a 529 plan grows on a tax-deferred basis and can be withdrawn tax-free when used to pay for qualified higher education expenses. Over 30 states also offer additional state income tax benefits that can be reinvested to boost college savings even further.

Parents who start to save for college when their child is a newborn can accumulate about a third of their college savings goal in earnings by the time the child is college age. The longer parents wait to start saving, the more they will have to contribute to a 529 plan each month to reach the same goal. For example, if parents wait until high school to start saving only 10% of their goal will come from earnings and they will have to contribute six times more per month to reach the same college savings goal.

However, it’s never too late to open a 529 plan, even if the beneficiary is in high school. Contributing $300 per month to a 529 plan over 4 years could add up to $15,000 in college savings, assuming the funds are invested in a conservative portfolio with a 2% annual investment return.

Best age to start a 529 plan

The best age to start a 529 plan depends on the individual. Young adults are often faced with major expenses and may have trouble finding room in their budget for college savings. A 529 plan can be opened before a child is born, but there may be other expenses that take priority, such as:

- Student loan repayments

- Buying a car, commuting costs

- Getting business attire for a first job

- Saving up for a security deposit or a down payment

- Funding retirement accounts

- Build an emergency fund

- Paying for a wedding

Once parents start having kids, however, they have new (and sometimes unexpected) expenses that could prevent them from saving for college, including:

- Fertility treatments

- Costs of adoption

- Taking parental leave with new baby

- Medical bills

- Diapers and clothing

- Baby stroller, crib and other gear

- Childcare

For most individuals, there is never an ideal time to start saving for college. The key is to avoid procrastinating and open a 529 plan as soon as you have someone to save for. If parents have their first child at age 26, the best time to open a 529 plan would be between the ages of 25 and 34.

Most 529 plans have very small or no initial contribution requirements, and there is no requirement to make monthly contributions. Parents can deposit as much as they want, whenever they want. Grandparents, friends and other relatives can help, too, by giving 529 plan contributions as gifts for baby showers, birthdays, holidays and graduations.

{{parent.title}}

{{parent.title}}

Login

Login