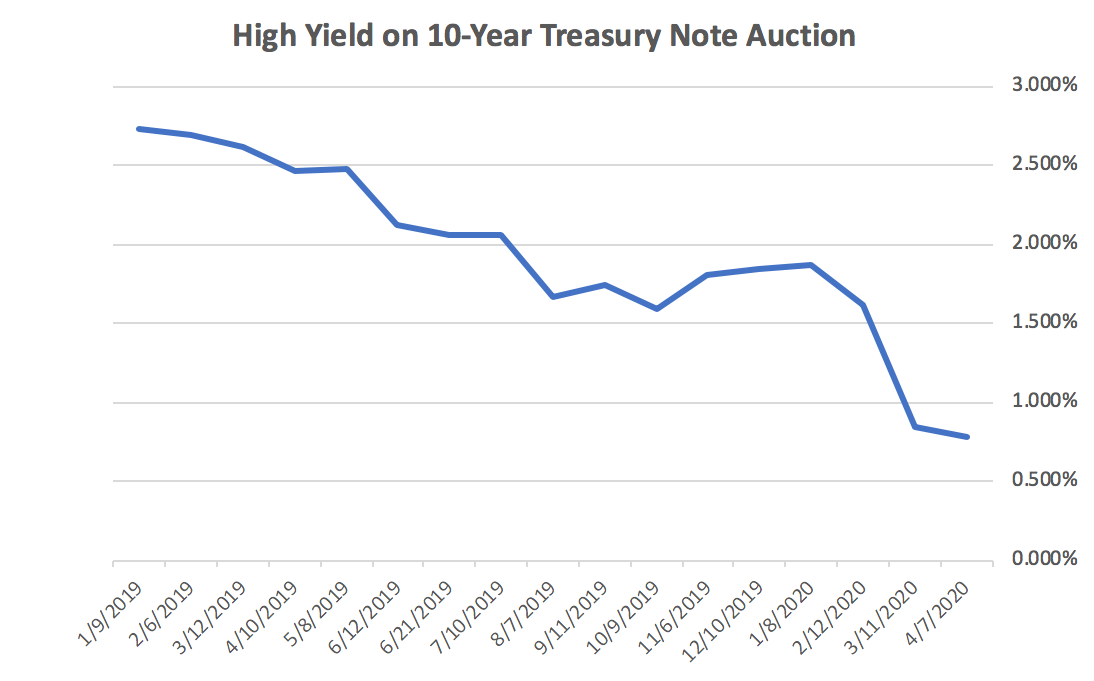

The April 10-year Treasury Note auction suggests that interest rates on federal student loans will drop by about 1.7 percentage points on July 1, 2020, setting a new record.

Interest rates on new federal student loans reset each July 1, based on the high yield of the last 10-year Treasury Note auction in May.

Normally, there is very little movement in the 10-year Treasury Note from April to May. The average magnitude of the change in the last 10 years was 16 bp (0.16%), with half the years showing an increase and half the years showing a decrease.

Thus, the April 10-year Treasury Note auction can be used to predict where interest rates on federal student loans are headed.

The April 7, 2020 auction had a high yield of 0.782%, down from 0.849% in March 11, 2020 and 2.479% in May 8, 2019.

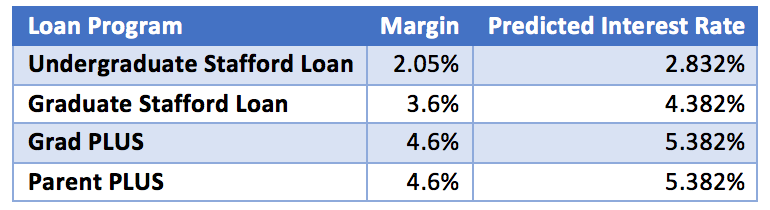

If federal student loans were based on this auction, instead of the May auction, the interest rates would be 2.83% on undergraduate Federal Direct Stafford Loans, 4.38% on graduate Federal Direct Stafford Loans, 5.38% on Federal Direct Grad PLUS Loans and 5.38% on Federal Direct Parent PLUS Loans.

That’s a decrease of 1.697% percentage points compared with interest rates during the 2019-2020 academic year.

The previous record low was set in 2005-2006, when interest rates on undergraduate Federal Stafford Loans reached 2.875% when consolidated.

This chart shows the high yield on the 10-year Treasury Note auction results since January 2019. The decline in interest rates has slowed recently.

{{parent.title}}

{{parent.title}}

Login

Login