Taking out student loans can be an effective way to bridge a college savings gap. But a new study shows that having student debt, no matter how much, has an impact on future retirement savings.

Student debt hurts retirement savings

According to a study from the Center for Retirement Research at Boston College, recent college graduates are more likely to participate in an employer-sponsored retirement plan than those with only a high school diploma. This was true whether or not they had student loan debt, and no matter what amount of debt they had.

However, college graduates with student debt were only able to save about half as much as those who graduated debt-free. The study also found that this was true no matter how large or small the graduate’s loan balance was.

One theory why this happens is that millennials are waiting to start saving for retirement until their student loans are paid off. Each day they wait to save they are missing out on potential savings that would compound over time.

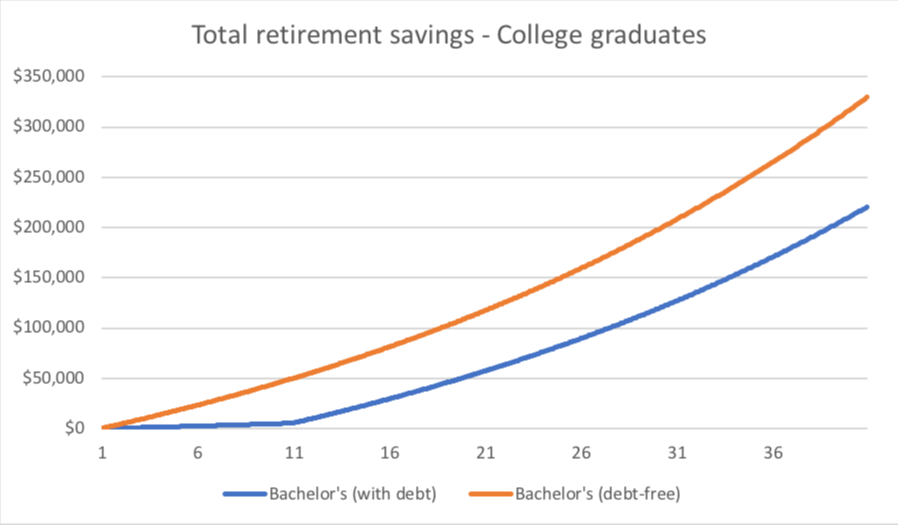

Suppose there are two students who graduate from college and began working at the same time. One student left college with $30,000 in student loans, with a monthly repayment obligation of $318.20. The other student graduated debt-free. Both earn an annual salary of $61,000 and want to contribute 7% of their income to a retirement plan. However, for the first 10 years the student loan borrower can only afford to contribute $38 per month after making his monthly loan payment. But during the same period, the debt-free graduate is able to contribute the full $356 per month. This results in an ending balance of $220,000 for the graduate with loans, and $328,000 for the debt-free graduate.

Source: Savingforcollege.com research. This chart is based on a theoretical model and represents a hypothetical example.

But not having a college degree hurts even more

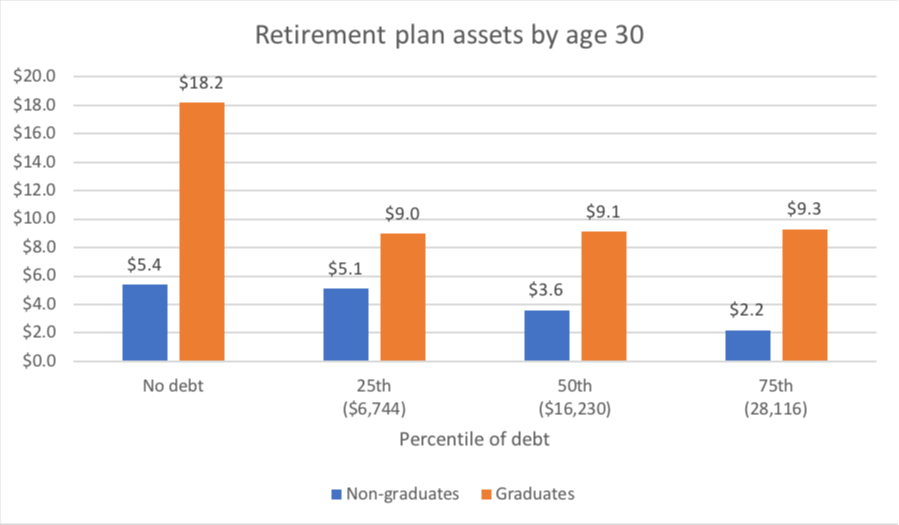

Having student loan debt may delay retirement contributions, but a college graduate (with or without loans) is still likely to have a larger retirement balance than a non-graduate. According to the study, at age 30 graduates with no debt had retirement assets worth around $18,000, compared to around $9,000 for graduates with student loan debt. Yet non-graduates had an even smaller balance. Thirty-year-olds with only a high school diploma and no student loan debt had around $4,000 less saved for retirement than college grads with large student loan balances.

Source: “Do Young Adults with Student Debt Save Less for Retirement?” Center for Retirement Research at Boston College.

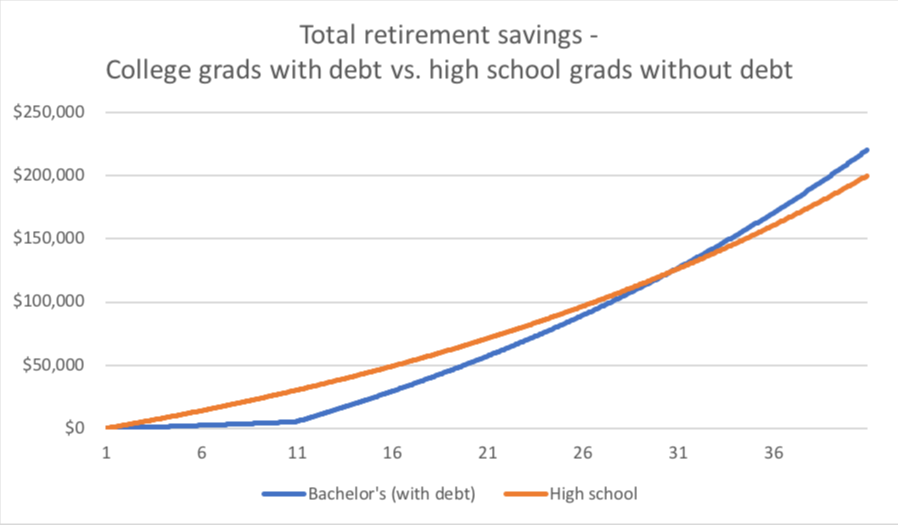

While the study provides a snapshot at age 30, the retirement savings of college graduates (with and without debt) will continue to grow at a faster pace than high school graduates all the way up until retirement. As illustrated in the hypothetical example below, high school graduates without debt will have an initial advantage over college graduates with debt – but only for the first 10 years until the loans are paid off. Once their debt is paid, college graduates will have a higher income and therefore be able to make larger contributions to their retirement plans.

The solution: Save for college

One of the easiest ways to obtain a college degree without debt is to start saving in advance. Remember, every dollar saved for college is one less the student will have to borrow. Instead of paying interest on loans during the first 10 years post-graduation, these students will able to begin making retirement contributions that will earn interest, as shown in the first chart. A 529 college savings plan can help parents save by offering tax-free growth and tax-free withdrawals when the funds are used to pay for qualified higher education expenses. This long-term investment will allow the child to start saving for retirement earlier and will also prevent parents from dipping into their own nest eggs to pay for college.

{{parent.title}}

{{parent.title}}

Login

Login