Deciding where to go to college is a pretty big deal. At college, you’ll be able to make new friends, learn new skills, take your first big step towards a career and truly discover your passions. It’s a once-in-a-lifetime experience.

But going to college is also a pretty big adjustment. You might find yourself in a new town, living on your own for the first time, and now handling your own finances.

So, how do you prepare for that adjustment? And more importantly, when should you start getting ready for college?

Start by taking a deep breath, because this isn’t going to be as scary as you think. Preparing for college is exciting, and you should feel good about it. But you’ve also got a lot of important choices to make along the way. We’re here to help.

This article will dive into all the basics of how to prepare for college. We’ll explain financial aid, when you should start getting ready for college and how to adjust your college savings strategy to finance your studies.

What should students know before going to college?

There are a few things you’ve got to know about before you go to college – and we’re not talking about ACT questions, here.

What do you need to know? As a high school student, you’ve got to have a basic understanding of financial literacy, what it takes to get into college and how college student funding actually works.

What does it take to get into college?

Before you think about sending in your college application, you’ve got to have a pretty good idea about what it’s going to take to get into college and how you’re going to get there.

Not sure where to begin? It’s best to kickstart your fact finding by chatting with your school guidance counselor.

By sitting with your guidance counselor in your freshman or sophomore year of high school, you’ll be able to get some no-nonsense advice on your academic performance and come up with a plan, tests (such as the ACT or SAT) you’ll want to take, and any changes you might need to make before graduating.

That could mean enrolling in elective classes that will broaden out your skills set and knowledge base.

But your guidance counselor may also advise you to enroll in some advanced placement (AP) classes if you’re eligible. By completing AP courses (and the exam that follows each course), you can earn college credits while still in high school.

You could even consider dual enrollment and take a few real college courses at your local university of community college while you’re still in high school.

Why? If you’ve got a few AP classes or college classes under your belt by the time you enroll full-time in college, you’ll probably be required to take less classes than a lot of your friends because you’ve already got college credits.

But getting ready for college isn’t just about studying and getting good grades.

You’ve also got to know what to expect when you arrive on campus. That’s why it’s always a great idea to plan a college visit to schools you’re considering and go to a college fair or two before you apply. This gives you a chance to chat with academics and college admission staff face-to-face, meet real students, and experience campus and college life first-hand.

How financial aid works

College isn’t cheap. For 2020/21, private schools were averaging $35,087 per year for tuition and fees alone. Even out-of-state public schools came in at an average of $21,148 a year. Most of us don’t have that lying around. That’s why it’s so important for you to understand how financial aid works before you go to college.

Generally speaking, most financial aid that students apply for is provided by the federal and state governments. But colleges, scholarship organizations, and even different employers provide financial aid, too. Financial aid is money to help you pay for college. Financial aid can come from your college, federal programs, state programs and even private sources. Financial aid includes grants, scholarships, student loans and the work-study program.

Because gift aid, such as grants, generally doesn’t need to be repaid, this is normally the type of aid that you’ll want to focus on collecting in the run up to college.

According to the National Center for Education Statistics (NCES), the vast majority of students accept financial aid to fund their studies. In 2018, 86% of undergraduates were awarded some form of financial aid from their college or the government.

Most financial aid opportunities can be found by completing the Free Application for Federal Student Aid (FAFSA). The FAFSA is how you qualify for grants, scholarships, eligibility into a work-study program and federal student loans (which need to be repaid, plus interest).

You can submit the FAFSA from October 1 of your senior year of high school and again every year you plan on attending college. Some aid is first-come, first-serve, so it’s a good idea to fill it out as early as you can.

It’s also important to bear in mind your college might have its own deadlines or application forms. When in doubt, ask your guidance counselor or get in touch with the admissions team at the college you’re considering. They’ll steer you right.

You should also apply for as many scholarships as you can. Scholarships are another form of aid that can come from a school, professional groups, religious groups, community organizations, nonprofits, social organizations and more.

Scholarships can be based on your academic achievement or a specific talent, such as an athletic or music ability. You can find scholarships based on ethnicity, gender, religion, where your parents work, what your chosen major is, and even for specific characteristics, such as being left-handed.

Another form of financial help for college is employer tuition assistance. Some companies will actually reimburse a portion of your college expenses if you or your parents are an employee.

Want to learn more about financial aid and how it works? Check out our Complete Guide to Financial Aid.

How to adjust your college savings plan

A college savings fund is an important tool to help pay for college. Even if you’re already in high school, it is not too late to start saving. Every dollar saved is one less you’ll need to borrow.

That means you’ve got to think about your college savings plan and make adjustments as you get closer to graduating high school and starting college.

If your parents or other relatives have been saving on your behalf using an investment tool like a 529 plan, you’ll want to discuss that plan with your parents.

According to the College Savings Plans Network, the average 529 plan balance is $25,664 as of June 2020.

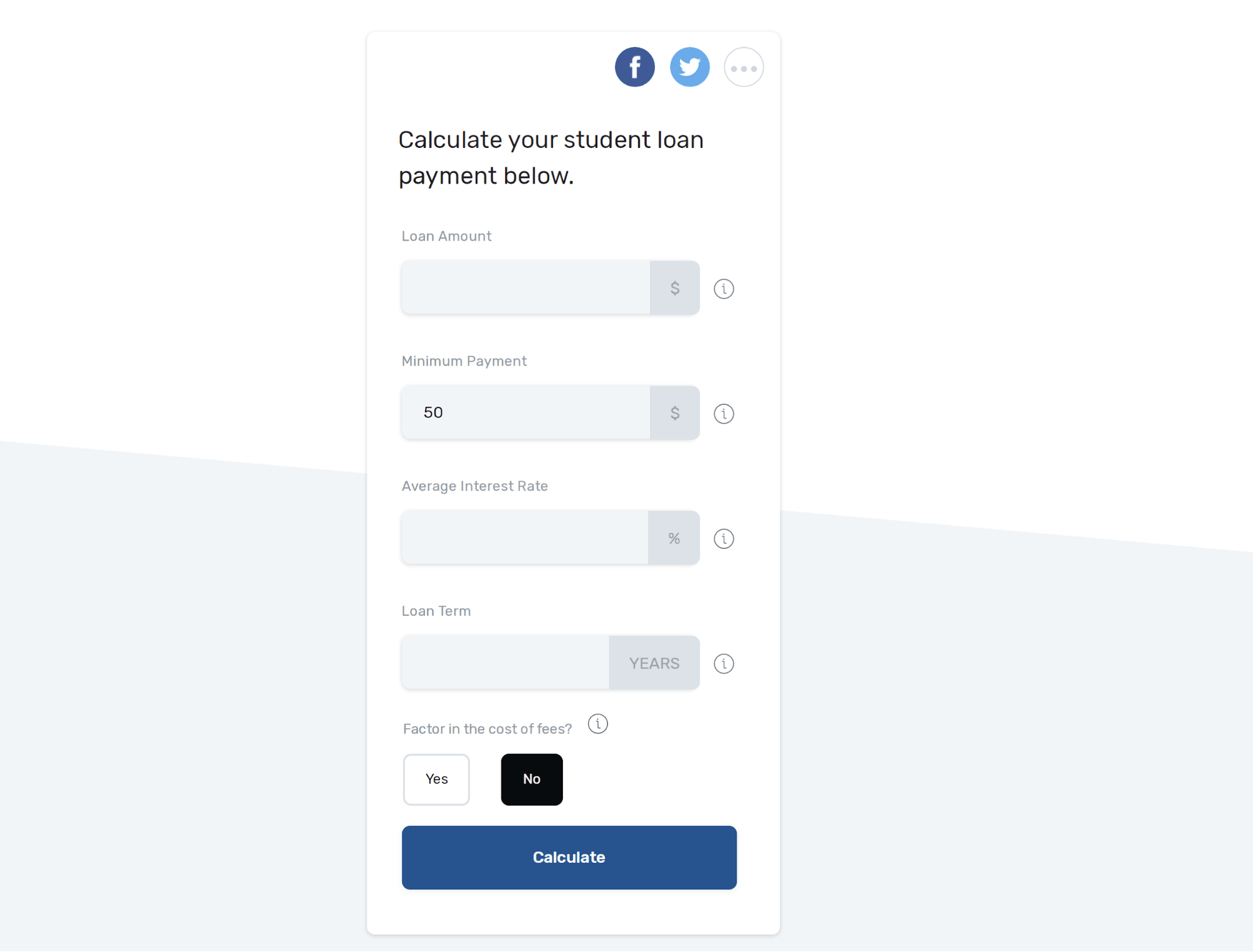

Want to calculate how much more it would cost you to borrow instead of save for college? Use our Savings vs. Loans calculator and start planning now.

So, sit down and assess your projected financial aid against the total costs you’re expecting to face if you pick one of the schools of your choice. Your parents or other relatives saving towards your college tuition fund may then need to increase their allocation to less risky assets or start to make bigger contributions.

Want to learn more about 529 plans? Check out our ranking of the Best 529 Plans of 2020.

When should you start preparing for college?

No two students are alike, and so your path to college won’t be exactly the same as your best friend’s path to college.

That being said, there are some landmarks and important deadlines you need to be aware of and try to keep up with if you want to stay on-track. To help give you a rough idea of when you need to start preparing for college, we’ll break down some of those landmarks.

When to apply for financial aid

Financial aid is normally split between grants and loans – but the way you apply for both types is the same if you’re seeking federal aid.

Remember that Free Application for Federal Student Aid (FAFSA) we’ve already talked about? Well, that’s how you apply for financial aid, and you can submit your FAFSA from October 1 of your senior year of high school.

The FAFSA deadline is either going to be June 30 at midnight Central Time (CT) on June 30 of the academic year or the end of the academic year, whichever comes first. But, deadlines to apply for some state-sponsored financial aid programs are sooner.

If you make any mistakes or need to make changes to your FAFSA after it’s been submitted, those changes need to be submitted by mid-September.

Why is it so important to submit your FAFSA on time? Because if you file the FAFSA during the first three months, you’re likely to get twice as much in grants.

It’s also important to remember that each college gets a fixed allocation of Federal Supplemental Educational Opportunity Grant (FSEOG) and Federal Work-Study (FWS) funding each year.

Translation: if you don’t apply fast, the money can run out. That could end your college career pretty quick. So do yourself a favor, and get that FAFSA in ASAP.

Want to learn more about when to apply for financial aid? Read our guide on FAFSA deadlines.

When to apply for a student loan

Student loans are a type of self-help financial aid that enables you to borrow money to pay for college and then pay it back over time with interest. That’s how loans are different from scholarships or grants: you don’t have to pay grants or scholarships back.

Before you borrow any student loans, be sure you have exhausted all other options first, including grants, scholarships and choosing an affordable college. There are companies that may help you pay for college, work colleges that allow you to work in exchange for paying for college and no-loan policy colleges.

There are two main types of student loans: federal loans and private loans. A federal loan is backed by the U.S. Government, while private loans are offered by various private lenders.

Federal loans are preferred over private loans because these loans offer many benefits. This includes the possibility to make payments based on your income, potential to have loans forgiven, options to pause your payments if you lose your job or for other reasons, loan discharge if you die or become disabled, and for students with financial need, potential for subsidized loans.

So, when do you apply for student loans?

To apply for a federal student loan you’ll need to file that FAFSA we keep going on about. In addition to deciding how much financial aid you may be eligible for, the information on your FAFSA will also help decide how much money you’ll get to borrow.

There are two main types of federal student loans: subsidized and unsubsidized loans. Subsidized loans means that the government pays the interest on the loan during approved times of deferments, such as if you’re in-school or if you lose your job. Unsubsidized loans do not offer this benefit.

After your application has been assessed, your college should then send you a financial aid offer. That offer will include details on how to accept your loan, and then you’ll be expected to sign a Master Promissory Note (MPN).

Private loans work differently.

You don’t need to fill out a FAFSA to secure a private student loan. You can do this directly with your lender, who will then check your credit score and will often require a creditworthy cosigner. The timescale for private loan applications will typically be shorter than a federal student loan, and so you won’t be as pressed for time to finalize a private student loan application.

There are some pros and cons of private loans you’ll need to be aware of. For example, private loans are usually more expensive than federal student loans because federal loans have relatively low fixed interest rates. Federal loans also offer more options for repayment plans if life throws you a curveball.

Questions about student loans? You’re in the right place. Check out our guide.

Conclusion

At the end of the day, getting ready for college doesn’t have to be stressful or scary.

That means discussing with your high school counselor and important people in your life what it takes to get into college, adjusting your savings plan, and learning about financial aid and how it works.

You’ve also got to stay on top of your financial aid application and be sure to send your FAFSA in ASAP during your senior year. Your FAFSA will determine how much aid you get and where that aid comes from — and so it’s really important to get it right.

But do yourself a favor, and don’t stress. Just stay focused, stay informed and keep your eye on the prize. You’ve got this, and there are plenty of great financial opportunities out there designed to help you reach your ambitions.

Ready to learn more about how you can prepare for college? Check out our College Savings 101 guide.

{{parent.title}}

{{parent.title}}

Login

Login