{{parent.cta_data.text}}

COMMUNITY

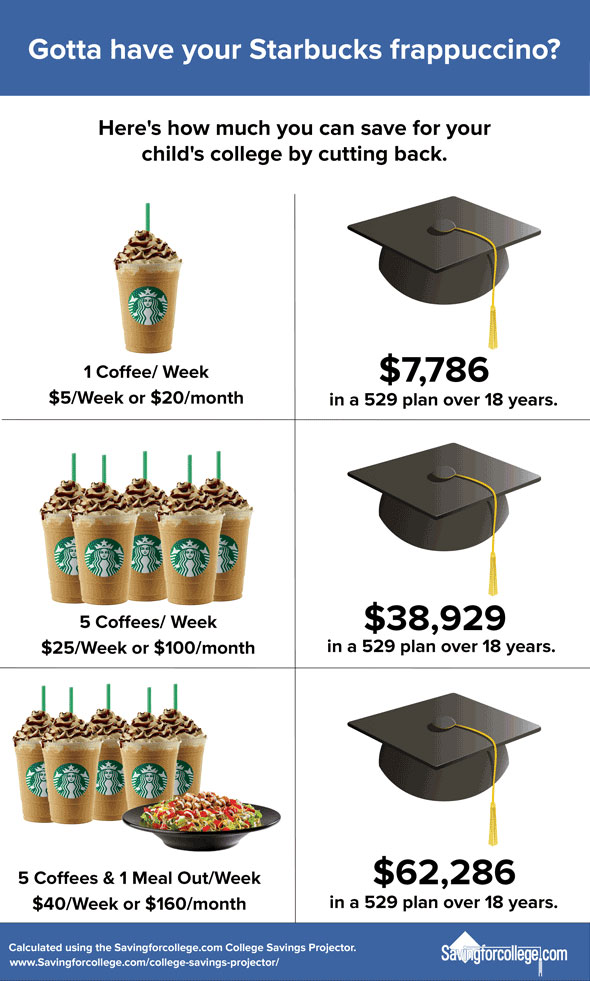

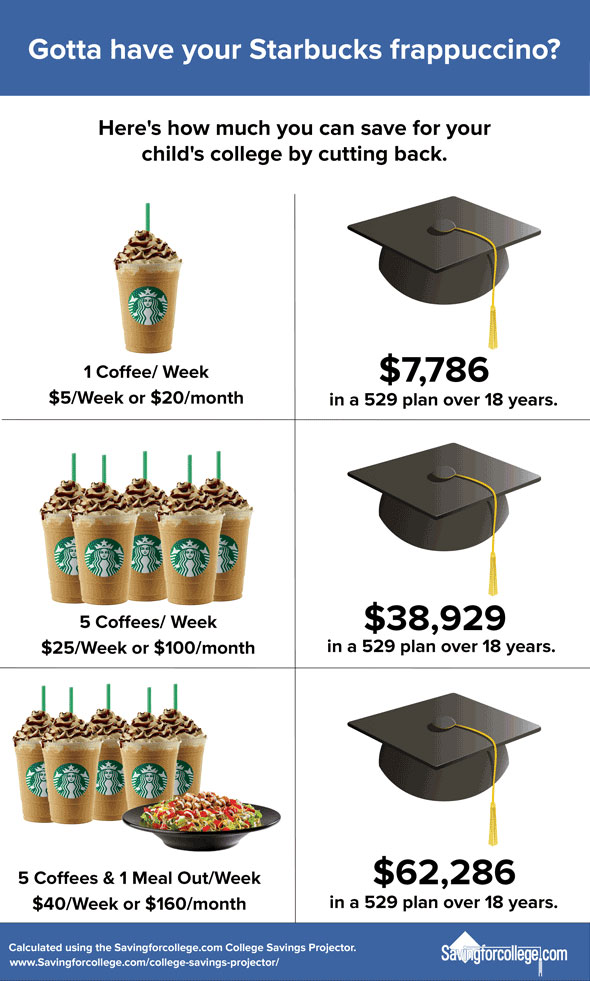

How much can parents really save for college by giving up Starbucks?

http://www.savingforcollege.com/articles/how-much-can-you-save-for-your-childs-college-by-giving-up-starbucks-791

Posted: 2015-06-12

Sallie Mae's How America Saves for College 2015 report showed us that while 89 percent of parents believe college is an investment in their child's future, many worry about how they will be able to save for it. So what if we told you that by giving up five trips to Starbucks and one meal out per week you could save enough to cover a full year of private school tuition in 18 years? That's right, by investing just $160 per month in a 529 college savings plan you could end up with $62,286 by the time your newborn is ready for college1.

A 529 plan works just like your 401(k) or IRA. You put your money in and it will grow based on the performance of the investment options you select. And just like your retirement account, these earnings will grow tax-free and will not be taxed when you withdraw the funds as long as they are used to pay for college. While your state may also offer additional tax breaks for residents who invest in their 529 plan, you can enroll in almost any state's plan regardless of where you live. And don't worry if you plan on sending your child to a college in another state. You can use your 529 savings to pay for all types of eligible colleges and universities all over the world.

Now, we understand that busy parents are not going to give up coffee. Heck, you'll probably need a cup or two just to get through your 529 plan application (just kidding – it's easy). But if you've really got to have your Starbuck's latte, or else you'll go insane – maybe cut back on one a week? You'll still be able to save $7,786 in 18 years. But when you consider that in 2032 the cost of a 4-year public university is expected be around $196,0002 you may want to stock up on Keurig cups instead!

1 Based on an annual investment return of 6%.

2 Based on a college inflation rate of 4%, Source: College Board

Sallie Mae's How America Saves for College 2015 report showed us that while 89 percent of parents believe college is an investment in their child's future, many worry about how they will be able to save for it. So what if we told you that by giving up five trips to Starbucks and one meal out per week you could save enough to cover a full year of private school tuition in 18 years? That's right, by investing just $160 per month in a 529 college savings plan you could end up with $62,286 by the time your newborn is ready for college1.

A 529 plan works just like your 401(k) or IRA. You put your money in and it will grow based on the performance of the investment options you select. And just like your retirement account, these earnings will grow tax-free and will not be taxed when you withdraw the funds as long as they are used to pay for college. While your state may also offer additional tax breaks for residents who invest in their 529 plan, you can enroll in almost any state's plan regardless of where you live. And don't worry if you plan on sending your child to a college in another state. You can use your 529 savings to pay for all types of eligible colleges and universities all over the world.

Now, we understand that busy parents are not going to give up coffee. Heck, you'll probably need a cup or two just to get through your 529 plan application (just kidding – it's easy). But if you've really got to have your Starbuck's latte, or else you'll go insane – maybe cut back on one a week? You'll still be able to save $7,786 in 18 years. But when you consider that in 2032 the cost of a 4-year public university is expected be around $196,0002 you may want to stock up on Keurig cups instead!

1 Based on an annual investment return of 6%.

2 Based on a college inflation rate of 4%, Source: College Board

If you liked this post and think it would help others save for college, please share!

Recommended Articles

SPONSOR CONTENT

Financial Professionals

Top 529 College Savings Plans

One-year rankings are based on a plan's average investment returns over the last 12 months.

| State | Plan Name | |

|---|---|---|

| 1 | Nevada | USAA 529 Education Savings Plan |

| 2 | Florida | Florida 529 Savings Plan |

| 3 | New Jersey | NJBEST 529 College Savings Plan |

Three-year rankings are based on a plan's average annual investment returns over the last three years.

| State | Plan Name | |

|---|---|---|

| 1 | South Dakota | CollegeAccess 529 (Direct-sold) |

| 2 | Wisconsin | Edvest 529 |

| 3 | Nevada | USAA 529 Education Savings Plan |

Five-year rankings are based on a plan's average annual investment returns over the last five years

| State | Plan Name | |

|---|---|---|

| 1 | Indiana | CollegeChoice 529 Direct Savings Plan |

| 2 | Florida | Florida 529 Savings Plan |

| 3 | Alaska | T. Rowe Price College Savings Plan |

10-year rankings are based on a plan's average annual investment returns over the last ten years.

| State | Plan Name | |

|---|---|---|

| 1 | West Virginia | SMART529 WV Direct College Savings Plan |

| 2 | South Carolina | Future Scholar 529 College Savings Plan (Direct-sold) |

| 3 | Ohio | Ohio's 529 Plan, CollegeAdvantage |

{{parent.title}}

{{parent.title}}

Login

Login