{{parent.cta_data.text}}

COLLEGE SAVINGS 101

New study from Fidelity shows why money for college makes a smart gift

http://www.savingforcollege.com/articles/new-study-from-fidelity-shows-why-money-for-college-makes-a-smart-gift-879

Posted: 2015-12-15

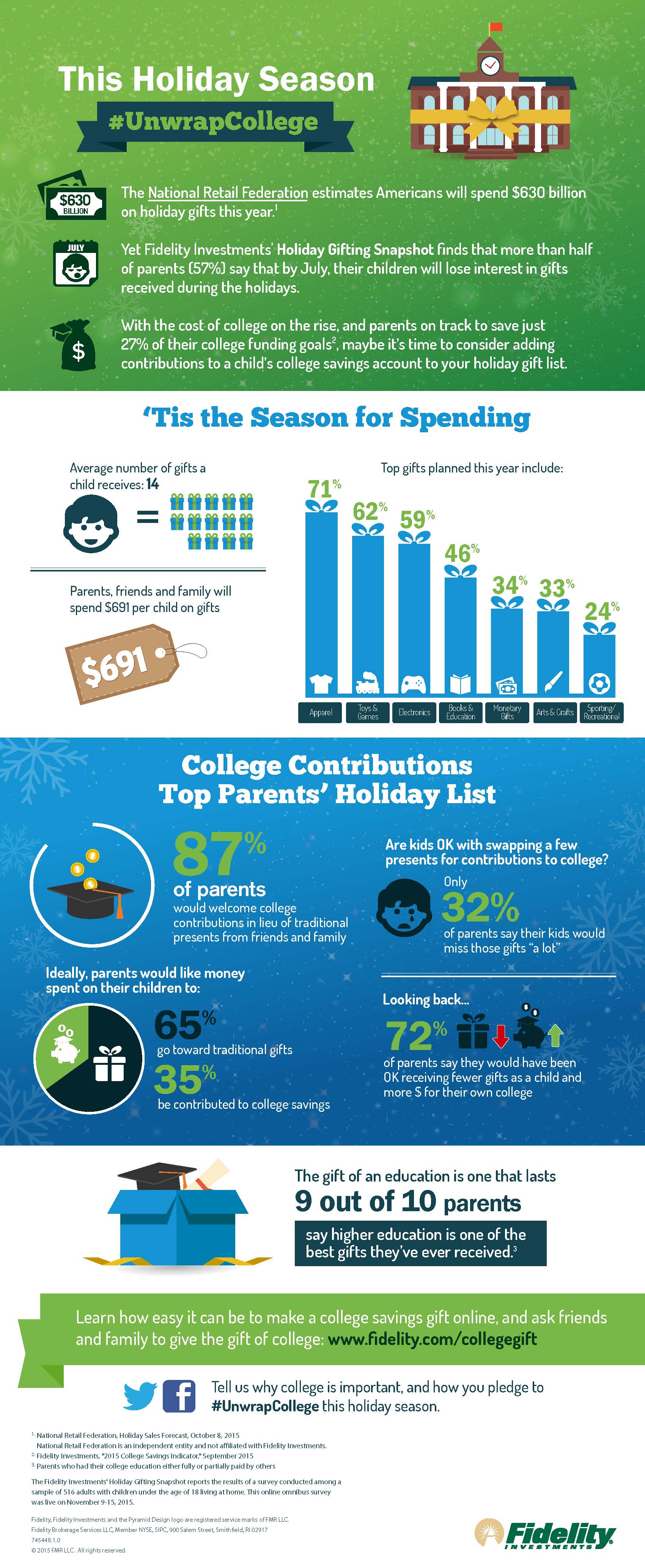

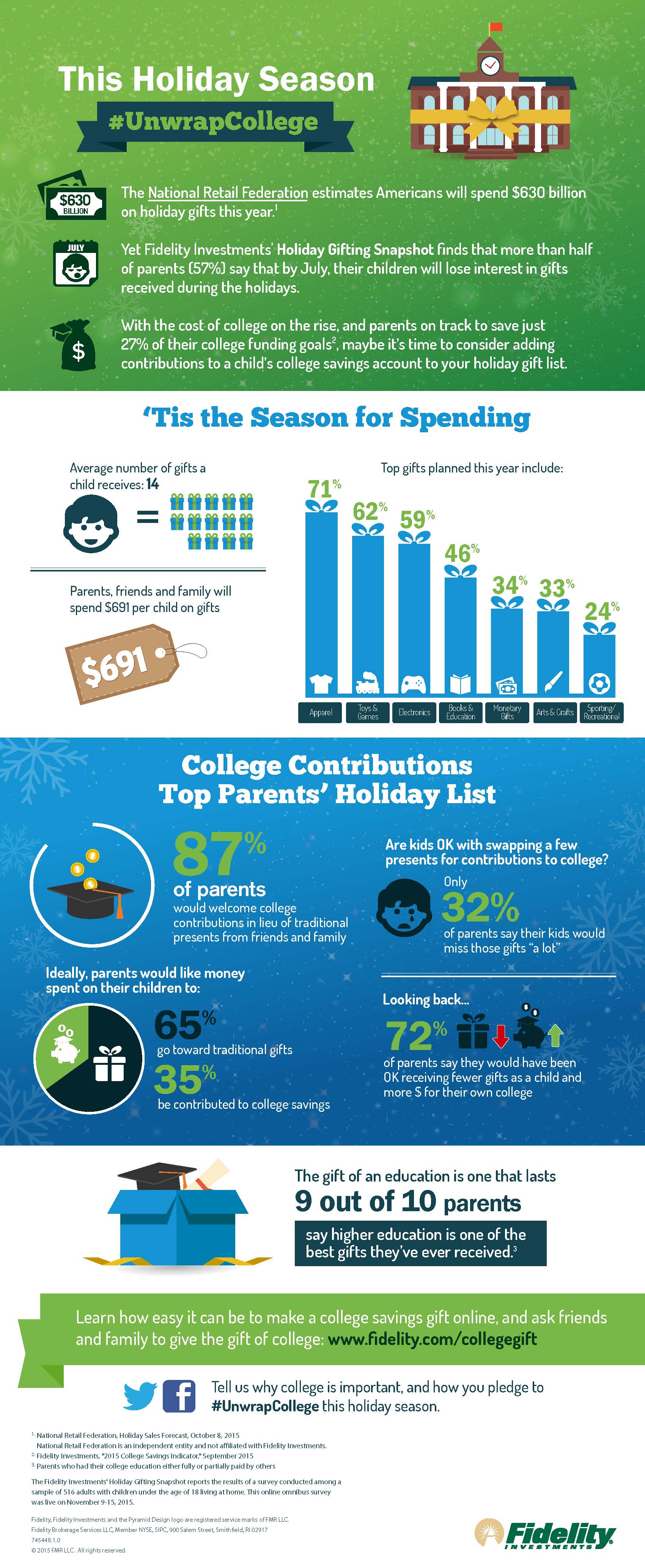

How soon will your kids lose interest in the toys they receive this holiday? Fidelity's Holiday Gifting Snapshot revealed 57% of parents think it will happen by July. And, according to the same study, an average of $691 will be spent on each child. That's quite a bit of money to spend on dolls or trucks that will be collecting dust at the bottom of the toy chest this summer. Wouldn't parents prefer their kids receive something more lasting and meaningful? The study shows they would. In fact, 87% of parents would welcome money for their child's future college education in lieu of traditional gifts. And while they prefer the majority of the money spent on the kids goes toward toys, games and other presents, they'd like to see 35% be contributed to their college funds.

But how do the kids feel about this? Children receive 14 holiday gifts on average, and when asked about giving some of them up for money for college, only 32% said they would miss those gifts "a lot". Unfortunately for those kids, in this case mom and dad know best. 72% of parents wish they received fewer gifts when they were younger and had more money for college. Every dollar saved for college is one less your child will have to borrow. And if you're saving with a 529 plan, the younger you start saving, the more time your money has to benefit from tax-free compounding.

Using the data from Fidelity as an example, let's say a family spends $691 on their three-year old child each holiday. Going forward however, they decide to save $242 (35%) of it in a 529 plan. Assuming a 6% annual investment return, in 15 years when the child is ready for college they will have accumulated $5,633. They'll be able to withdraw that amount tax-free as long as they spend it on tuition, fees, supplies and room and board at any eligible post-secondary institution.

RELATED: How much can you contribute to a 529 plan in 2015?

How soon will your kids lose interest in the toys they receive this holiday? Fidelity's Holiday Gifting Snapshot revealed 57% of parents think it will happen by July. And, according to the same study, an average of $691 will be spent on each child. That's quite a bit of money to spend on dolls or trucks that will be collecting dust at the bottom of the toy chest this summer. Wouldn't parents prefer their kids receive something more lasting and meaningful? The study shows they would. In fact, 87% of parents would welcome money for their child's future college education in lieu of traditional gifts. And while they prefer the majority of the money spent on the kids goes toward toys, games and other presents, they'd like to see 35% be contributed to their college funds.

But how do the kids feel about this? Children receive 14 holiday gifts on average, and when asked about giving some of them up for money for college, only 32% said they would miss those gifts "a lot". Unfortunately for those kids, in this case mom and dad know best. 72% of parents wish they received fewer gifts when they were younger and had more money for college. Every dollar saved for college is one less your child will have to borrow. And if you're saving with a 529 plan, the younger you start saving, the more time your money has to benefit from tax-free compounding.

Using the data from Fidelity as an example, let's say a family spends $691 on their three-year old child each holiday. Going forward however, they decide to save $242 (35%) of it in a 529 plan. Assuming a 6% annual investment return, in 15 years when the child is ready for college they will have accumulated $5,633. They'll be able to withdraw that amount tax-free as long as they spend it on tuition, fees, supplies and room and board at any eligible post-secondary institution.

RELATED: How much can you contribute to a 529 plan in 2015?

If you liked this post and think it would help others save for college, please share!

Recommended Articles

SPONSOR CONTENT

Financial Professionals

Top 529 College Savings Plans

One-year rankings are based on a plan's average investment returns over the last 12 months.

| State | Plan Name | |

|---|---|---|

| 1 | Nevada | USAA 529 Education Savings Plan |

| 2 | Florida | Florida 529 Savings Plan |

| 3 | New Jersey | NJBEST 529 College Savings Plan |

Three-year rankings are based on a plan's average annual investment returns over the last three years.

| State | Plan Name | |

|---|---|---|

| 1 | South Dakota | CollegeAccess 529 (Direct-sold) |

| 2 | Wisconsin | Edvest 529 |

| 3 | Nevada | USAA 529 Education Savings Plan |

Five-year rankings are based on a plan's average annual investment returns over the last five years

| State | Plan Name | |

|---|---|---|

| 1 | Indiana | CollegeChoice 529 Direct Savings Plan |

| 2 | Florida | Florida 529 Savings Plan |

| 3 | Alaska | T. Rowe Price College Savings Plan |

10-year rankings are based on a plan's average annual investment returns over the last ten years.

| State | Plan Name | |

|---|---|---|

| 1 | West Virginia | SMART529 WV Direct College Savings Plan |

| 2 | South Carolina | Future Scholar 529 College Savings Plan (Direct-sold) |

| 3 | Ohio | Ohio's 529 Plan, CollegeAdvantage |

{{parent.title}}

{{parent.title}}

Login

Login