{{parent.cta_data.text}}

COLLEGE SAVINGS 101

Clearing up the confusion: Five popular 529 plan myths

http://www.savingforcollege.com/articles/clearing-up-the-confusion-five-popular-529-plan-myths

Posted: 2014-04-10

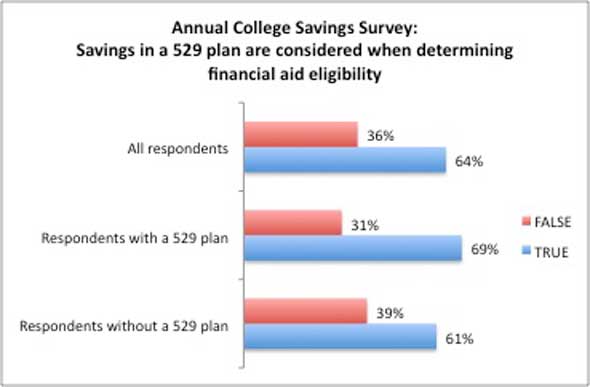

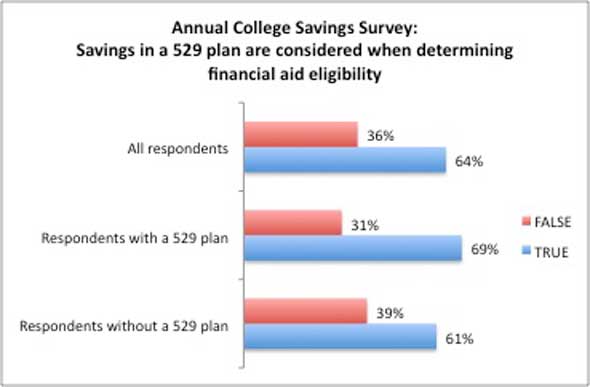

Recent survey data has indicated that parents' misunderstanding of 529 plans may be a significant barrier to their use of them. In this slideshow we present five of the biggest 529 plan myths along with the facts to set the record straight.

Myth #1: Money in a studentís 529 account will not affect financial aid eligibility.

Facts:

- The amount of financial aid a student receives is based on the studentís Expected Family Contribution (EFC).

- 20 percent of a studentís assets are counted toward their EFC, but only up to 5.64 percent of parentsí assets are counted.

- Money saved in a 529 account owned by a parent or student is considered a parental asset.

- As long as the 529 plan is owned by the parent or student, distributions from it are not required to be reported as income on the FAFSA.

- If a grandparent or other relative owns a 529 account, the assets will have no effect on financial aid.

- However, qualified distributions from the account will be treated as untaxed income to the beneficiary on the subsequent year's financial aid application and will be counted as the studentís assets. Therefore, it may be wise for relatives to wait to help pay for college until senior year.

Myth #2: A child has legal rights to money in a 529 account.

Facts:

- The owner of a 529 account retains control of the assets regardless of the age of the beneficiary.

- This is one of the biggest differences between 529 plans and custodial accounts under the Uniform Gift to Minors Act (UGMA), where the funds are the property of the child and can be used as they wish once they reach legal age (usually 18-21, depending on the state of residence).

Myth #3: I am required to use my own stateís 529 plan, and the funds must be used toward a college in my own state.

Facts:

- Some states offer state income tax incentives for residents, but you are not required to use your own stateís plan.

- If you decide to use another stateís plan, you will still reap the federal tax benefits.

- Funds saved in a 529 account can be used at almost any school in the U.S. and even some international schools, no matter where the account owner lives.

Myth #4: If my child doesnít go to college, or I use the money for something else, Iíll get hit with a penalty tax on everything Iíve saved.

Facts:

- If you end up using the funds in a 529 account for something other than qualified educational expenses, only the earnings portion would incur the 10% penalty tax. An exception to this penalty can be claimed if the beneficiary has died or is disabled, or attends a U.S. Military academy.

- However, you would owe federal and state income tax on the earnings.

- Additionally, if you received a state income tax deduction on contributions, in many cases you would have to repay those taxes.

- You will not incur any additional federal taxes on the contribution portion since it was made with after-tax money.

Myth #5: I will have to pay a penalty tax if my child is awarded a full ride.

Facts:

- There is a special exception to the penalty tax rule when a student receives a scholarship.

- Distributions up to the amount of the tax-free scholarship will not be subject to the 10% penalty tax, although the earnings portion would still be subject to income tax.

- Qualified educational expenses are not limited to tuition. You can take advantage of tax-free distributions toward purchases that are required for the enrollment and attendance at an eligible educational institution. This can include room and board, books, fees, supplies and equipment.

- If you choose to leave the funds in the 529 account, you can change the beneficiary to another family member who is planning on going to college or save the funds if the child is going to graduate school.

Recent survey data has indicated that parents' misunderstanding of 529 plans may be a significant barrier to their use of them. In this slideshow we present five of the biggest 529 plan myths along with the facts to set the record straight.

Myth #1: Money in a studentís 529 account will not affect financial aid eligibility.

Facts:

- The amount of financial aid a student receives is based on the studentís Expected Family Contribution (EFC).

- 20 percent of a studentís assets are counted toward their EFC, but only up to 5.64 percent of parentsí assets are counted.

- Money saved in a 529 account owned by a parent or student is considered a parental asset.

- As long as the 529 plan is owned by the parent or student, distributions from it are not required to be reported as income on the FAFSA.

- If a grandparent or other relative owns a 529 account, the assets will have no effect on financial aid.

- However, qualified distributions from the account will be treated as untaxed income to the beneficiary on the subsequent year's financial aid application and will be counted as the studentís assets. Therefore, it may be wise for relatives to wait to help pay for college until senior year.

Myth #2: A child has legal rights to money in a 529 account.

Facts:

- The owner of a 529 account retains control of the assets regardless of the age of the beneficiary.

- This is one of the biggest differences between 529 plans and custodial accounts under the Uniform Gift to Minors Act (UGMA), where the funds are the property of the child and can be used as they wish once they reach legal age (usually 18-21, depending on the state of residence).

Myth #3: I am required to use my own stateís 529 plan, and the funds must be used toward a college in my own state.

Facts:

- Some states offer state income tax incentives for residents, but you are not required to use your own stateís plan.

- If you decide to use another stateís plan, you will still reap the federal tax benefits.

- Funds saved in a 529 account can be used at almost any school in the U.S. and even some international schools, no matter where the account owner lives.

Myth #4: If my child doesnít go to college, or I use the money for something else, Iíll get hit with a penalty tax on everything Iíve saved.

Facts:

- If you end up using the funds in a 529 account for something other than qualified educational expenses, only the earnings portion would incur the 10% penalty tax. An exception to this penalty can be claimed if the beneficiary has died or is disabled, or attends a U.S. Military academy.

- However, you would owe federal and state income tax on the earnings.

- Additionally, if you received a state income tax deduction on contributions, in many cases you would have to repay those taxes.

- You will not incur any additional federal taxes on the contribution portion since it was made with after-tax money.

Myth #5: I will have to pay a penalty tax if my child is awarded a full ride.

Facts:

- There is a special exception to the penalty tax rule when a student receives a scholarship.

- Distributions up to the amount of the tax-free scholarship will not be subject to the 10% penalty tax, although the earnings portion would still be subject to income tax.

- Qualified educational expenses are not limited to tuition. You can take advantage of tax-free distributions toward purchases that are required for the enrollment and attendance at an eligible educational institution. This can include room and board, books, fees, supplies and equipment.

- If you choose to leave the funds in the 529 account, you can change the beneficiary to another family member who is planning on going to college or save the funds if the child is going to graduate school.

If you liked this post and think it would help others save for college, please share!

Recommended Articles

SPONSOR CONTENT

Financial Professionals

Top 529 College Savings Plans

One-year rankings are based on a plan's average investment returns over the last 12 months.

| State | Plan Name | |

|---|---|---|

| 1 | Nevada | USAA 529 Education Savings Plan |

| 2 | Florida | Florida 529 Savings Plan |

| 3 | New Jersey | NJBEST 529 College Savings Plan |

Three-year rankings are based on a plan's average annual investment returns over the last three years.

| State | Plan Name | |

|---|---|---|

| 1 | South Dakota | CollegeAccess 529 (Direct-sold) |

| 2 | Wisconsin | Edvest 529 |

| 3 | Nevada | USAA 529 Education Savings Plan |

Five-year rankings are based on a plan's average annual investment returns over the last five years

| State | Plan Name | |

|---|---|---|

| 1 | Indiana | CollegeChoice 529 Direct Savings Plan |

| 2 | Florida | Florida 529 Savings Plan |

| 3 | Alaska | T. Rowe Price College Savings Plan |

10-year rankings are based on a plan's average annual investment returns over the last ten years.

| State | Plan Name | |

|---|---|---|

| 1 | West Virginia | SMART529 WV Direct College Savings Plan |

| 2 | South Carolina | Future Scholar 529 College Savings Plan (Direct-sold) |

| 3 | Ohio | Ohio's 529 Plan, CollegeAdvantage |

{{parent.title}}

{{parent.title}}

Login

Login